Shares of insurer Express Scripts and other health-care related stocks slid Tuesday after Amazon, J.P. Morgan and Berkshire Hathaway announced a partnership to improve employee health.

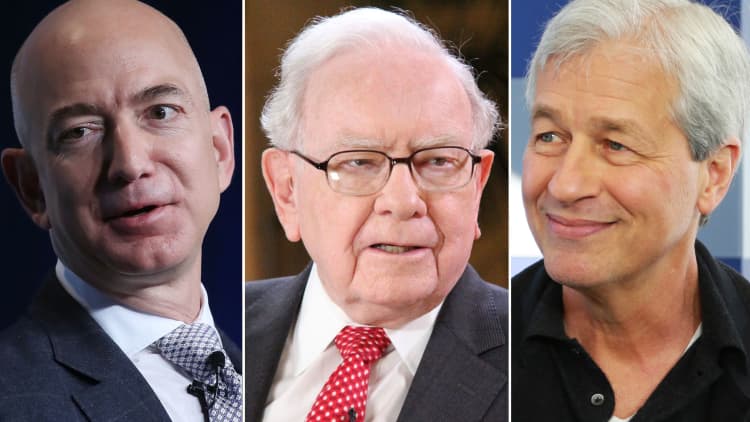

The three companies, led by Jeff Bezos, Jamie Dimon and Warren Buffett, plan to develop ways to improve the health of their employees, with the goal of improving customer satisfaction and reducing costs.

"The three companies, which bring their scale and complementary expertise to this long-term effort, will pursue this objective through an independent company that is free from profit-making incentives and constraints," the announcement said.

Drug distributor Express Scripts' stock fell 5 percent by midday. Cigna was off by 6 percent, CVS Health dropped 4 percent and Walgreens Boots Alliance fell 5 percent. UnitedHealth Group also was down 4 percent and Aetna fell by about 2 percent.

Details of the new company were still unclear, but that didn't stop traders from sending these shares reeling on the notion that these three titans of business could shine a light on where these companies need lower costs.

Pharmaceutical companies Pfizer and Amgen also slipped, down 3.2 percent and 3.1 percent respectively.

"The comments in the press release suggest that these leaders view this as an endeavor that is complex, challenging and thorny and that will take time to bear fruit,"wrote Ana Gupte, analyst at Leerink Partners. "It is unclear if this means Amazon will accelerate its entry into the pharmacy supply chain, though the quest for transparency, which is lacking currently in drug pricing and also in broader healthcare delivery in America, would point to a more transformative effort by the new entity."

The announcement comes amid months of speculation that Amazon's Bezos would lead the e-commerce giant into the health-care space.

"The healthcare system is complex, and we enter into this challenge open-eyed about the degree of difficulty," Bezos said in the announcement. "Hard as it might be, reducing healthcare's burden on the economy while improving outcomes for employees and their families would be worth the effort."

A key issue for the Trump administration, the rising cost of health care and pharmaceuticals has frequently drawn criticism from President Donald Trump.

Trump said in October that his administration would stop paying Obamacare insurers billions of dollars in reimbursements for discounts that insurers must give by law to low-income customers of their plans.

"If this winds up being the low cost provider to make insurance more affordable at employer level, could wind up being a real disruptive competitor to an industry that has not seen any new players in years/decades," Jefferies analyst Jared Holz said in email. "[I'm] not going to call this [a] black swan event yet because there are few details and would be making too many assumptions but it has potential to be."

Buffett and Dimon also commented on the new company in the press release.

"The ballooning costs of healthcare act as a hungry tapeworm on the American economy. Our group does not come to this problem with answers. But we also do not accept it as inevitable," Berkshire's Buffett said.

"Our people want transparency, knowledge and control when it comes to managing their healthcare," said JP.P. Morgan's Dimon. "The three of our companies have extraordinary resources, and our goal is to create solutions that benefit our U.S. employees."

Shares of Amazon, J.P. Morgan, and Berkshire Hathaway were little changed.

—CNBC's Meg Tirrell contributed to this report.