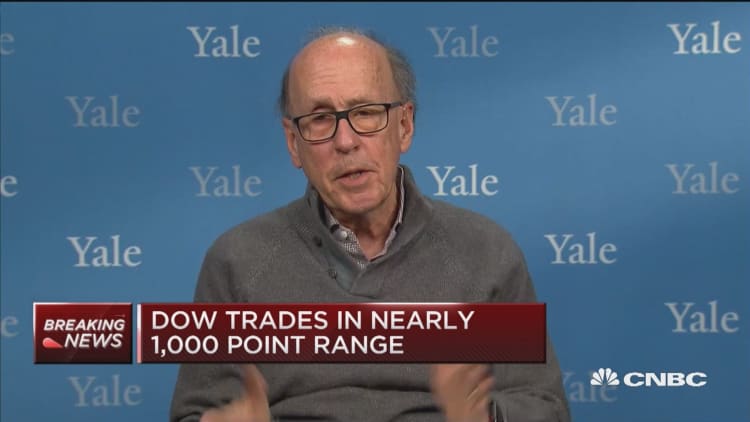

While investors may be concerned about higher inflation, Yale University fellow Stephen Roach told CNBC on Tuesday that he expects inflation to remain below target.

"Central banks, I think, will take heed of that and will be slow and reluctant to normalize," the former chairman of Morgan Stanley Asia said in an interview with "Power Lunch."

"That continues to feed the beast in terms of injecting a lot of liquidity into markets."

Global markets continued their wild ride Tuesday. In the United States, the Dow Jones industrial average traded in a range of 1,167.49 points, swinging as low as 567.01 points and rising as much as 600.48 points. The blue-chip index ultimately closed 567.02 points higher.

Roach blames central banks for "distorting asset prices across the spectrum" over the past several years.

The Federal Reserve, European Central Bank and Bank of Japan all massively expanded their balance sheets to the tune of about $8 trillion between 2008 and 2017, while nominal gross domestic product was up by $2 trillion, Roach said.

Therefore, there has been $6 trillion of excess liquidity pumped into the global markets during that time, he said.

"Now central banks are starting to move the other way, led by the Fed, followed eventually by the ECB and the BOJ. So the sustenance of these liquidity-driven markets is being sucked out as we speak."

— CNBC's Fred Imbert contributed to this story.