European equities finished Tuesday's trade on a relatively negative note, as caution continued to linger following the U.S.-led market sell-off last week.

European markets

The pan-European Stoxx 600 ended the session down 0.63 percent provisionally, with most sectors moving into the red by the close.

On the bourses front, the French CAC 40 slipped 0.6 percent, while Germany's DAX fell 0.7 percent. The U.K.'s FTSE 100 fluctuated around the flatline, before closing down 0.13 percent at the close.

A series of corporate earnings Tuesday yielded both positive and negative reactions on European trading floors throughout the session.

Telecoms sink 1.1%

Telecoms tumbled 1.10 percent as a sector by the close as earnings continue to trickle in. Shares of Telenet fell 5.46 percent on dividend concerns after the Belgian operator posted its 2017 results. Inmarsat slipped 5.67 percent after HSBC cut its price target on the stock.

The travel and leisure sector closed slightly up, one of two sectors to do so. Within the group, TUI closed in positive territory but off session highs after reporting earnings that revealed that current trading performance for this summer fully matched the firm's expectations.

Looking at individual stocks, Ubisoft surged 6.15 percent, making it the STOXX 600's top performer after reporting higher revenues for its third quarter.

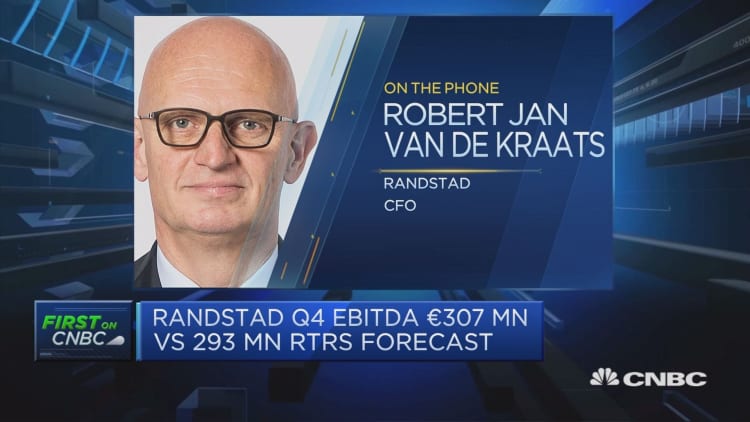

Meanwhile, Randstad, the world's second-largest staffing company, rose 2 percent after beating analysts expectations with a core profit up by 15 percent in its fourth quarter.

Metals producer Aurubis announced that operating earnings before taxes came in at 79 million euros, for the first quarter, up from 18 million euros seen in the previous year. The company also remained positive on the outlook; however, shares of the firm slipped 8 percent as earnings came in below market expectations.

Kering fell some 4 percent despite reporting a 56.3 percent increase in adjusted operating income for 2017, which came in at 2.95 billion euros.

UK inflation holds steady

U.K. consumer price inflation remained at 3 percent in January, the same level as in December. The rate, as reported by the Office of National Statistics (ONS), was slightly higher than analysts' forecasts. Most economists were expecting a small fall in the CPI to 2.9 percent.

Investors were keeping a close eye on Wall Street following recent volatility, with U.S. stocks falling around Europe's close, with the Dow off more than 100 points.

In commodity markets, oil prices gave up their gains on Tuesday, after a forecasting agency projected global crude supply could overtake demand later this year. Crude prices came off session lows around Europe's closing bell, with Brent trading at $62.36 at 4:30 p.m. London time, and WTI hovering at $58.93.

However, basic resources outpaced fellow sectors, finishing up 0.98 percent, as a sharp uptick in metal prices boosted London-listed miners, including Anglo American, BHP Billiton and Glencore, which all closed up above 1.5 percent.