Credit Suisse is defending a controversial financial product it issued that played a role in the staggering market losses last week.

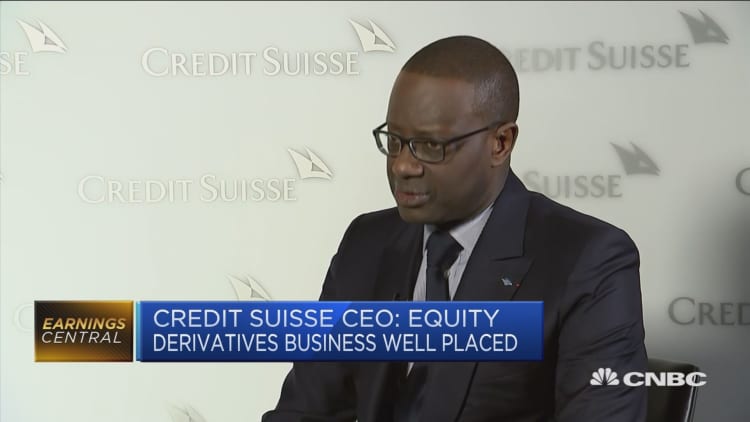

People shorted volatility at their own risk, Credit Suisse CEO Tidjane Thiam told CNBC on Wednesday, when asked about the losses suffered by investors who held shares of complex volatility trading products, the most popular of which was managed by his bank.

Following a flood of criticism from market commentators and financial firms alike, Thiam insisted that the product's demise was not a hit to the bank's reputation.

"It is a legitimate market instrument that serves a purpose, is very useful for market participants to manage their risk," he said. "And yes it has had a lot of attention because this kind of short volatility, long S&P trade was run by a lot of people, at their own risk, and it worked well for a long time until it didn't. Which is generally what happens in markets."

Shorting volatility

On Monday last week, as markets sold off and the Dow Jones industrial average plunged nearly 1,600 points, many analysts pointed to the XIV, which was operated by Credit Suisse, as having amplified selling.

The XIV stands for the VelocityShares Daily Inverse VIX Short-Term exchange-traded note (ETN). The product, of which Credit Suisse 32 percent, shorts volatility by betting on calm market conditions. It became one of the most popular trades of the past year as volatility in the Cboe Volatility Index (VIX) — a fear gauge for the stock market — reached historic lows.

But because the XIV was designed to produce opposite returns of the VIX, when the volatility index shot through the roof Monday, the XIV went through the floor, down a devastating 90 percent. The ensuing negative feedback loop of selling is believed to have seriously exacerbated Monday's market turmoil.

The ETNs, worth a combined $1.6 billion the previous Friday, lost 92 percent of their value by Tuesday's end, forcing Credit Suisse to close the fund.

'Not a proper investment vehicle'

Thiam said that the product's prospectus made clear it was meant for daily trading rather than long-term holding, emphasizing that investors were warned about the potential risks.

"It's not a proper investment vehicle," Thiam said. "So we also said because of that, because the price can vary so brutally, the prospectus says that if the price goes down 80 percent, we can close it."

When the VIX went from a low of 17 points to end the day at 38, the value of the instrument (the XIV) went from 100 to 5. "And once you're at 5, given the structure of the note, there is no prospect of recovery … The product was basically not usable anymore," he added.

The Switzerland-based bank announced last week that it has experienced no losses from its financial instrument. Instead, it appeared the fallout was squarely borne by investors holding the product.