Credit Suisse posted its third consecutive annual loss on Wednesday, highlighting writedowns in the fourth quarter of 2017 due to the overhaul of the U.S. tax system.

It reported a net loss of 983 million Swiss francs ($1.05 billion) for the year and said that it paid 2.74 billion Swiss francs in income tax expenses, primarily related to the re-assessment of deferred taxes resulting from the U.S. tax changes.

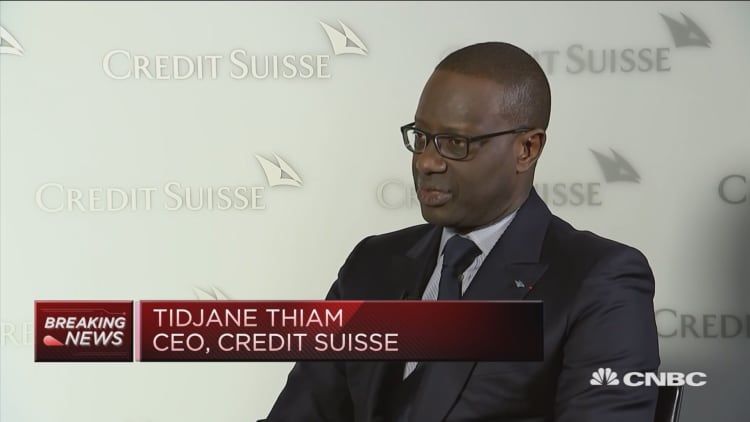

"(The bank) is in a better place (from a year ago)," Tidjane Thiam, chief executive of Credit Suisse, told CNBC Tuesday.

"If you look at the results we announced today and the key things in the results, we talked a lot about operating leverage i.e. We are working hard to increase revenue and reduce cost. We were able to do that at the bank level as a whole."

Overall, the results came in above market expectations, with Reuters analysts estimating a full-year net loss of 1.1 billion Swiss francs. The bank posted a loss of 2.1 billion Swiss francs in its fourth quarter due to the writedown, better than the 2.6 billion franc loss reported this time last year.

The bank's capital position also improved in the last quarter of 2017. Its CET 1 ratio rose to 12.8 percent from 11.5 percent in the last quarter of 2016. Thiam said 2017 was a "crucial year" of delivery in its three-year restructuring plan.

He added in a statement that the bank managed to show profitable growth and that every division increased its return on capital, with particular momentum in its wealth management business. This unit saw an increase of 13 percent year-on-year for its assets under management.

Too early for share buyback

Despite the improved position from a year ago, Credit Suisse announced a dividend of 0.25 Swiss francs per share — slightly below market expectations of 0.28 Swiss francs per share.

Speaking to CNBC, Thiam said that it's "too early" to announce any share buybacks or higher dividends.

"It's too early. We said that our philosophy would be to generate significant surpluses and to distribute 50 percent of that to shareholders either as a dividend or as a share buyback," he said.

The stock was up by 2.5 percent in early European trading on Wednesday.

However, 2018 could be the turning point. "This year should be the first year where that (surplus) number is actually meaningful," Thiam said. "We should generate 4 to 5 billion (francs) of surplus in (2018) which can then be distributed."

Thiam pointed out that, nonetheless, it is up to the bank's board to make that decision.

Cautious short-term outlook

Looking at 2018, Credit Suisse said that its market-dependent activities are subject to a number of uncertainties, including changes to interest rates across the world, and it was adopting a "cautious short-term outlook" based on the recent market volatility.

"In the first six weeks of 2018, we have seen a significant pick-up in market volatility, which on the one hand had a positive impact on our secondary activities, and on the other hand, negatively impacted our primary calendar as clients wait for calmer markets in order to transact," the bank said in a statement.