The allegation by a whistleblower, in a letter to the Securities and Exchange Commission, of potential manipulation of the VIX, a key gauge of market fear and volatility, "rings true," a former market regulator told CNBC on Wednesday.

Formally called the Cboe Volatility Index, the VIX measures market expectations of near-term volatility conveyed by stock index option prices.

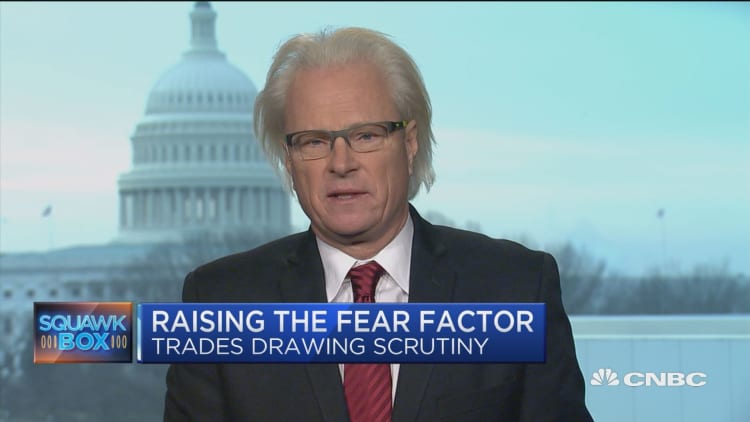

"The VIX has been suspect for at least seven years," Bart Chilton, former commissioner of the Commodity Futures Trading Commission said on "Squawk Box." The CFTC aims to protect market participants from fraud, manipulation and abusive practices related to financial derivatives such as futures and options. "People have been concerned about prices being pushed around. Although, there's never been any hard evidence," he said.

The whistleblower, who would only describe himself a 20-year veteran of buy side firms, told CNBC that the manipulation he's seen through "irregular patterns" contributed to last week's market plunge. He said he's never personally attempted to manipulate the VIX and he's never directly seen anyone do it.

The Cboe said in a statement about the whistleblower: "This letter is replete with inaccurate statements, misconceptions and factual errors, including a fundamental misunderstanding of the relationship between the VIX Index, VIX futures and volatility ETPs [exchange-traded products], among other things. As a result of these errors, we feel the conclusionary statements contained in this letter lack credibility."

However, Chilton said the VIX manipulation allegation "rings true to me," adding that "there's certainly enough smoke."

"I don't have the details like I did back in the day," he admitted, but said, "I've had traders contact me and tell me they've lost money. They think prices are being pushed around."

The Cboe was not immediately available to respond to a CNBC inquiry for a comment on Chilton's remarks.

As a former regulator, Chilton said that regardless of whether there's been VIX meddling, some of the leveraged products tied to the fear gauge are "toxic" and present "incredible" risks to the market.

"So many things are based upon the VIX, other products, that there's contagion really quickly," he said.

That contagion played out last week when an obscure exchange-traded note designed as a bet on calm markets blew up when the stocks went off the rails. Investors were forced to unwind their positions, a cascading effect that spilled over into the broader market. Credit Suisse, which issues the ETN, said trading in the product would end later this month.

At the least, Chilton said these type of volatility-linked exchange-traded products should have "additional disclosure" of the risks on the downside because "you can lose two and three times your investment and these ETPs that we're talking about are compounded daily."

With these little-known ETPs as ticking time bombs and allegations of VIX manipulation, Chilton said he would not be surprised if investors lost some confidence in the system.

But he said regulators need to put new rules in place around highly risky products, and get to the bottom of whether there's been any wrongdoing concerning the VIX itself.