Oil-related stocks in Asia traded higher on Friday as oil prices recorded slight gains after touching two-week highs in the previous session.

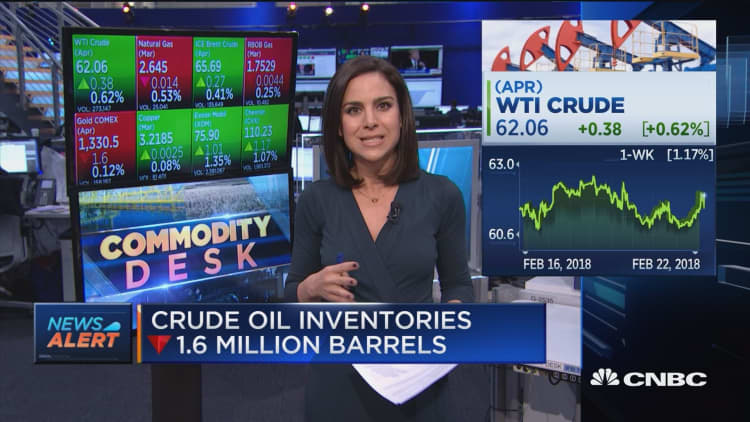

Those gains in oil prices had come after U.S. crude stocks unexpectedly declined by 1.6 million barrels in the week ending Feb. 16, Reuters said, citing data from the U.S. Energy Information Administration. That compared to the 1.8 million-barrel rise in inventories forecast by experts.

Woodside Petroleum, Australia's largest oil and gas company, was up 0.56 percent following those increases in prices. Other oil producers also gained: Santos rose 0.39 percent and Oil Search rose 1.46 percent.

More broadly, the S&P/ASX 200 energy sub-index traded higher by 0.68 percent in the afternoon Sydney time.

Energy stocks in Japan saw sharper gains, with oil producer Inpex trading higher by 2.55 percent and Cosmo Energy gaining 4.59 percent. JXTG Holdings, Japan's largest refiner, was up 3.58 percent.

Meanwhile, Hong Kong-listed shares of Chinese oil producer CNOOC rose 0.88 percent in late morning trade local time. Oil giant China Petroleum and Chemical Corporation, or Sinopec, added 1.11 percent.

Oil prices were mostly steady on Friday. U.S. West Texas Intermediate crude futures advanced 0.05 percent to trade at $62.80 per barrel and Brent crude futures were off by 0.02 percent at $66.38.

"The unexpected fall in oil inventories in the U.S. should see support for crude oil prices remain strong," said ANZ Research analysts in a Friday morning note.

"Prices were also supported by comments from UAE Energy Minister Suhail Al Mazrouei, who said the worry is undersupply, not oversupply, as demand remains strong amid the constraints on output," they added.