Zelle — an in-app, person-to-person payments system backed by Bank of America, Wells Fargo and dozens of other major U.S. banks — is less than a year out from launch, but it has already rivaled industry leader PayPal in payment volume.

Fewer than half of Zelle's 60-plus partner banks had launched the service as of late last month — according to a spokesperson — but the payment system still moved $75 billion in 2017, more than double the $35 billion PayPal's Venmo moved in the same period.

Mobile payments are an increasingly important battleground for financial institutions as millennials continue to abandon cash and checks for digital payment methods.

"The banks do have scale," KeyBanc analyst Josh Beck said. "They're probably in a good position to tackle this market."

It's not necessarily a winner-take-all market, according to several analysts, but it's one traditional banks are desperate to enter. And while Zelle finds its footing, its competitors get a boost from the broadening industry and rise of cashless banking.

Banks want millennials opening accounts, and they're hoping popular services will keep them there. Millennials want easy and instant mobile payments, and have already proven they don't mind leaving the bank for them.

Zelle acts as a bridge between big banks, processing mobile, person-to-person payments much like Venmo or Square's Cash app. But Zelle works faster and is aimed at keeping coveted millennial banking customers in house.

"It's a battleground for them," Beck said. "In their heart of hearts, the banks are quite concerned about Venmo."

PayPal's Venmo cornered the market early, with a clean interface, a level of widespread adoption necessary for end-to-end transactions and a social component that Zelle notably lacks.

Venmo allows users to attach subject lines, emojis and comments to a transaction, which then populate a single feed (minus the dollar amount).

Money changes hands, friends laugh about funny memo lines and a broader network gets a glimpse at your enviable weekend plans.

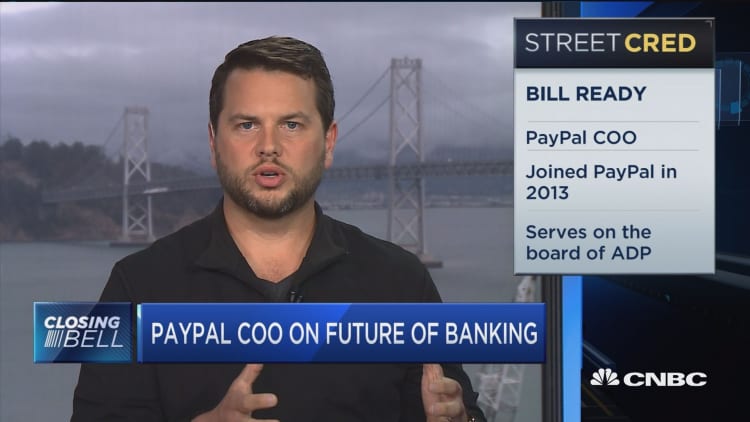

"It's not just a conversation about money. It's really a conversation about the experience you had," PayPal COO Bill Ready told CNBC. "It's not about just splitting the tab. It's about who had one glass of wine too many."

Venmo is just one page in PayPal's mobile payments portfolio, though — the company, across all of its P2P platforms, moved $27 billion in the last quarter alone — so Zelle hasn't proven to be a threat yet.

"We have tremendous momentum behind our broader [person-to-person segment]," Ready said. "As other players come into the space, our growth has only accelerated."

New players in the sector, Ready said, contribute to broader user education, bringing new users into the ecosystem and, in many cases, sending them to the established incumbents.

Zelle, though, stands to capitalize on an older demographic less concerned with social features and more concerned with security. It's also no-fee, where the Venmo and Cash apps take a small percentage for certain transactions.

The rollout has been gradual and thus far quiet, as individual banks integrate Zelle into their banking apps.

The adoption challenge for Zelle is a unique one. Banks don't have to educate users on the functionality of Zelle or convince them to download the service. Instead they have to inform users they already have Zelle on their phones, in their banking apps.

The service has launched a massive multiplatform ad campaign and plans to air more 3,000 TV ads in the first quarter featuring Daveed Diggs, star of the musical "Hamilton."

The goal is to "broaden digital payments from millennials to mainstream," a Zelle spokesperson told CNBC, but that doesn't inherently eliminate competition from third-party processors like PayPal and Square.

Adding users to Zelle doesn't mean taking them off PayPal, according to several analysts. The use case for Venmo differs from that of Zelle — the same user is likely to send a few dollars through Venmo, but a few thousand through Zelle.

"Zelle represents more of a threat to cash and checks rather than Venmo," Evercore analyst David Togut said.

Correction: An earlier version of this story mistakenly said that Zelle had surpassed PayPal's P2P volume.