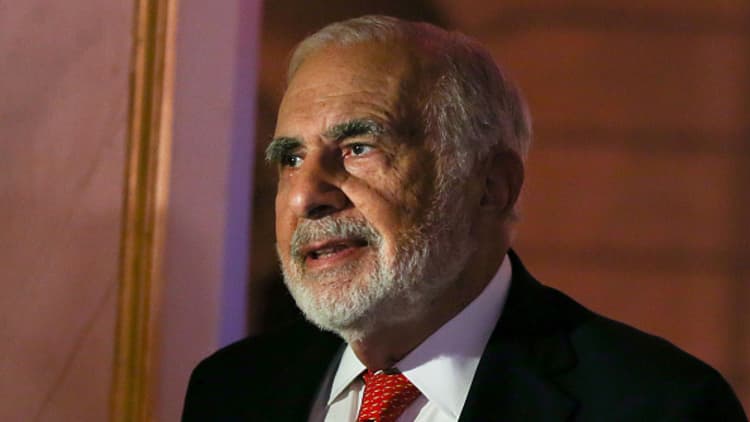

Billionaire investor Carl Icahn told CNBC on Thursday that he focuses on "simplistic, but obvious things" when trying to gauge the direction of the stock market, especially during these highly volatile times.

Ignore all the day-to-day headlines out of Washington, he said on "Fast Money Halftime Report," even as equities on concerns about a trade war after President Donald Trump announced steel and aluminum tariffs.

"I'm not concerned about a trade war," Icahn said. "I think the major thing you have to worry about and think about is creeping inflation."

"If you have creeping inflation, I think you're going to have higher interest rates, which I think might be difficult to deal with for the market," he added.

That's exactly what sparked the stock market correction last month: a higher-than-expected average hourly earnings number in January's jobs report ignited fears that inflation might finally be coming to life, and in response the Federal Reserve may look to hike rates more aggressively than the three projected increases for this year.

For its part, the bond market has certainly not been waiting for the Fed, with traders recently pushing the yield on the 10-year Treasury to four-year highs before backing off a bit.

"I do not really think, especially at this time — I don't say this facetiously — that anybody really knows which way this market is going to go on a short-term basis. I really think there are too many variables," Icahn said. "I think you have to have a hedged position for somebody who's got a major position."

The tax reform law championed by Trump and Republican leaders on Capitol Hill also has been a scapegoat for Wall Street strategists trying to explain the market swings. The narrative goes that tax relief on top of an already-strengthening economy will also stoke inflation and all the negative consequences that come with it.

But Icahn, an early supporter of Trump and later a one-time informal advisor to the president, said he believes the benefits of the tax overhaul, especially the federal corporate rate cut from 35 percent to 21 percent will be more positive for the economy than negative in the long run.

"The tax cuts I think are positive because I think the more money you have outside of the spending ability of Washington the better. In other words, I don't believe in big government," he said. "My whole philosophy is entrepreneurship" and how companies, when allowed to keep more of their profits, will deploy capital in more constructive ways than government, he added.

The chairman of Icahn Enterprises, who has been investing in the market for four decades, often targets struggling companies as an activist in hopes of bringing about changes to boost the market value of their stocks and improve their businesses.

Icahn also told CNBC on Thursday that he has made $1 billion on paper on his long bet on Herbalife, a company that fellow hedge fund billionaire Bill Ackman bet against and recently closed his disastrous position entirely. Icahn also said he has a large stake in Rubbermaid maker Newell, calling the stock "undervalued."

WATCH: Full Icahn interview