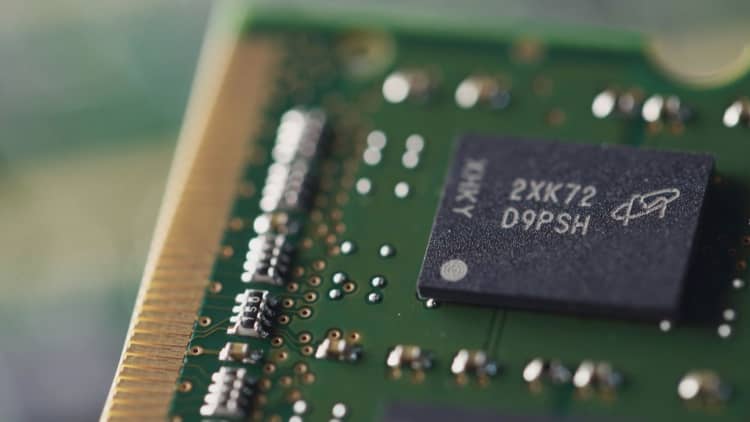

There's a new biggest Micron bull on Wall Street.

Nomura Instinet raised its 12-month price target to $100 from $55 for the chipmaker, representing 83 percent upside to Friday's close. It is now the highest Micron price forecast out of the 26 research shops that cover the company, according to FactSet.

The firm also reiterated its buy rating for the stock, predicting higher memory prices and increased shareholder capital return.

"We see DRAM [memory] pricing resuming an upward trend in Q2, a first-time dividend and share buyback announcement in May, continued margin expansion in NAND [flash memory] and increased M&A discussion as important catalysts," analyst Romit Shah wrote in a note to clients Monday. "We believe Micron shares are in the early stages of another major breakout. … We are raising our target substantially."

Micron shares closed 8.7 percent higher Monday after the report.

The analyst said memory prices are down only 3 percent this year versus the typical 10 percent to 20 percent decline in the first-quarter seen in the past three years. He predicts prices will rise by 10 percent within six months.

"Our research indicates that suppliers will begin raising prices in Q2 and Q3," he wrote. "This outlook sharply contrasts with Street expectations of a 5-6% sequential decline in each of the following 4 quarters (May-Feb 19)."

Micron announced it will have its analyst and investor day on May 21.

"During this event, we expect a comprehensive capital return program that, among other things, will demonstrate management's confidence in future cash flows," Shah wrote.

Micron is one of the best-performing stocks in the market this year. The company's shares are up 33 percent year to date through Friday compared with the S&P 500's 4 percent return.