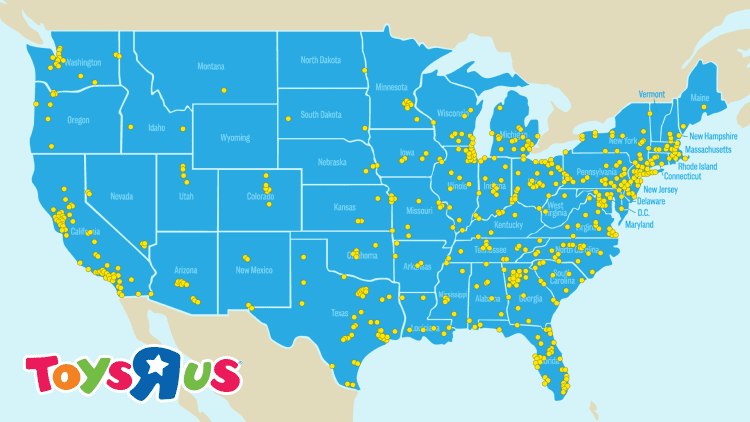

Toys R Us is planning to close or sell more than 800 stores across the U.S., leaving a surplus of unoccupied real estate on the market.

The abrupt shuttering of the toy chain spells good news and bad news for landlords. Some are betting on being able to find more profitable uses, while others will be left scrambling to find replacements.

"An important distinction between Toys and other recent bankruptcies is that many of Toys' leases [today] are well-below market — a silver lining for landlords," analysts from Green Street Advisors wrote in a note to clients.

In the case of Toys R Us, they added, there's an opportunity for real estate owners to secure new tenants paying higher rents per square foot, and that would mean a much better outcome.

Still, many of the Toys R Us and Babies R Us locations on the chopping block are more than 40,000 square feet, some are more than 65,000, and this is "problematic as the list of retailers seeking that [floor plan] is short," Green Street wrote. "More bankruptcies is putting further pressure on big box market rents."

The retail real estate industry has had its share of departures by key tenants in the past, including Circuit City, Sports Authority and RadioShack. Toys R Us' moves are viewed as further dragging down the reputation of U.S. strip centers anchored by bigger boxes.

Retailers that tend to occupy more space along shopping centers today include Dick's Sporting Goods, Big Lots, Party City and Best Buy — and these retailers aren't adding as many stores as they once were. Even Target and Kohl's are focused more on opening smaller-format stores. And investments are moving online.

More recently, though, some companies have said they will be willing to open more stores once rents stabilize.

"We have slowed down our store growth ... [because] we think that the real estate prices are going to continue to fall," Dick's Sporting Goods CEO Ed Stack said on a call with analysts and investors earlier this week.

"We're going to wait, and let's see what happens with the real estate prices with additional store closings," Stack said just two days before Toys R Us made its liquidation plans official.

Starbucks co-founder and Executive Chairman Howard Schultz made a similar comment late last month when asked about the coffee giant's U.S. expansion plans.

Schultz said he's seen an "abundance of empty storefronts across the country," predicting that rents would fall further. "This is not going to be a cyclical change in our occupancy expenses, but a permanent lowering of the cost of our real estate."

Toys R Us' departure could spur some of these businesses to grow again, if the price is right.

Landlords left scrambling

Only a small percentage of buildings occupied by Toys R Us are owned by U.S. real estate investment trusts. But REIT stocks have taken a beating on the fallout, with investors looking for ways to trade on the news.

Many of Toys R Us' U.S. locations are leased back to a separate entity created by the company known as Toys R Us Property Co., or Propco. REITs including Simon (13 small-format locations at its outlets), Kimco (24 stores), Brixmor (12 stores), Weingarten (four stores) and DDR (20 stores) own a handful of shops, while the remainder is owned directly by the toy retailer, securities filings show.

Urban Edge Properties, a spinoff from Vornado, which played a role in acquiring Toys R Us in 2015, has a larger percentage of exposure to the retailer with nine locations in its portfolio of only 90 centers.

Some REITs have already told CNBC they plan to redevelop existing Toys R Us locations to fit a handful of smaller companies once the liquidation process is complete.

Not many landlords foresaw the liquidation, announced Thursday. They were expecting some possible closures in a restructuring after Toys R Us emerged from its Chapter 11 bankruptcy filing last September, but not to this magnitude.

Analysts have drawn parallels to when big-box retailer Sports Authority initially hoped to reorganize its business but ultimately was forced in 2016 to shutter its roughly 460 stores after a failed attempt to find a bidder. Some of those locations are still looking for replacements, people familiar with the real estate market told CNBC.

"There was ample demand for the [Sports Authority] space, but the turnaround time from losing a large box tenant and the new tenant(s) occupying space is 1.5 – 2.0 years," RBC Capital Markets analyst Wes Golladay said.

In the case of Toys R Us, he added, "ideally, the landlords will look to re-tenant with retailers such as off-price retailers, which would require less reconfiguration." Companies like TJ Maxx and Homegoods owner TJX and Ross Stores are still actively adding more locations.

A spokesman from Kimco told CNBC: "During the liquidation process, some leases may be acquired by other tenants, which would limit downtime and lost rent, while the bigger opportunity ... is the ability to recapture some of these older boxes, which may spark potential future redevelopments and help unlock the embedded value of the real estate in our core U.S. markets."

A similar situation has been playing out as Sears Holdings closes stores (both Sears within malls and Kmart at shopping centers). Many landlords have welcomed the opportunity to recapture those spaces for other uses, landing tenants that can pay more per square foot.

Toys R Us is still shopping a deal that would save as many as 200 of its U.S. stores from going dark. It hasn't disclosed which locations could be saved. The company also hasn't yet provided a timeline on other liquidation sales.

WATCH: Toy store margins being crushed by internet, says former CEO