Demand for Nvidia's chips will suffer from waning digital currency mining demand this year, according to a Wall Street firm.

Wells Fargo Securities lowered its profit forecast for Nvidia, citing the dramatic drop in ethereum prices so far this year.

"In recent months ... we felt that there were multiple risks associated with Nvidia's exposure to cryptocurrency mining and our concerns over the sustainability of Nvidia's gaming, automotive and datacenter growth," analyst David Wong wrote in a Sunday note to clients entitled "We See A Significant Rise In Risk."

"In the last few weeks cryptocurrency prices have dropped significantly; we are trimming our below-consensus EPS and revenue estimates."

Nvidia shares fell 4.6 percent Monday after the report.

Wong reiterated his underperform rating on Nvidia shares and his $100 price target, representing 57 percent downside to Thursday's close.

Cryptocurrency miners use graphics cards based on AMD's and Nvidia's chips to "mine" new coins, which can then be sold or held for future appreciation. Digital currency ethereum is up about than 700 percent over the past 12 months, but is down nearly 70 percent from its January high, according to Coinbase data.

As a result, the analyst lowered his fiscal 2019 earnings per share forecast for Nvidia to $5.26 from $5.39.

"We think that falling demand for GPUs [graphics processing unit] used in cryptocurrency mining could impact Nvidia's July 2018 and subsequent quarters," he wrote.

Nvidia did not immediately respond to a request for comment.

— CNBC's Michael Bloom contributed to this story.

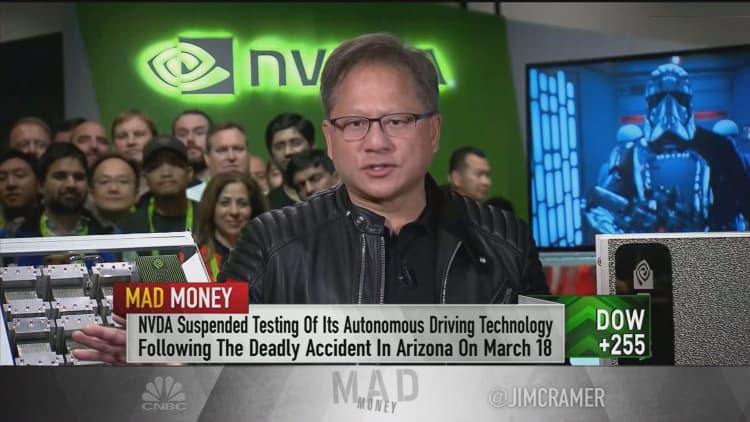

WATCH: Uber accident drove home importance of self-driving tech, says Nvidia CEO