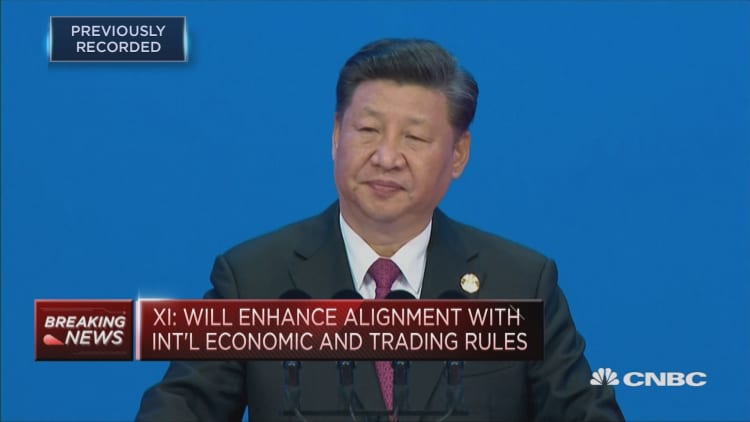

Chinese President Xi Jinping pledged a more open China on Tuesday, during a speech at a business forum in Boao on the southern island of Hainan.

Markets in Asia were encouraged by Xi's softer tone in the brewing trade war between the U.S. and China.

Here is a quick recap of what investors need to know:

The Promises

Xi highlighted action that Beijing would take to "break new ground" on opening up the Chinese economy.

He promised that the new measures would turn into reality sooner rather than later. These include:

- Raise foreign equity limits in securities, insurers and banks

- Lower auto tariffs

- Ease restrictions on foreign ownership in manufacturing (ships, aircraft and autos)

- Empower a new state agency to enforce intellectual property rights protection.

The Winners

There was some good news for American companies, however.

Tesla is seen as the biggest potential winner. The electric vehicle (EV) company depends on imports for its sales in China, where the tariff on imported cars is 25 percent. If that tariff were to drop significantly, it could be a "game changer," Michael Dunne, founder of Automotive Resources Asia, said.

Unlike other American car-makers, Tesla does not have factories in China. Xi didn't provide any clarity on whether foreign automakers would be able to set up manufacturing facilities without Chinese joint venture partners entirely, but since Beijing wants to dominate EV technology and develop its own EV supply chain, some in China's auto industry have speculated that Tesla could receive favorable treatment.

Elsewhere, J.P. Morgan and BlackRock are both looking to expand their asset management businesses in China, said Peter Alexander, founder of Z-Ben Advisors. "Among U.S. managers, the likes of JPM, Blackrock and Invesco are currently the best positioned. They've been strategically adept — more than others — and have multiple platforms to access the China market," he said.

Met Life has its toe in the Chinese market and could also benefit, said Sam Radwan, CEO of ENHANCE International. He added that the life insurance industry would likely see changes first.

The Promise Fatigue

However, there's a reason why so many American business executives in China were underwhelmed by Xi's pledged reforms.

The decision to lift foreign equity caps was announced at the end of 2017 and the mechanisms to achieve this are already underway.

Other policies, such as the lowering of auto tariffs, are not seen as meaningful since most U.S. cars that are sold in China are made in China.

Automotive Resources Asia's Dunne said that out of the 5.2 million vehicles sold by GM, Ford and Chrysler in China, only 1 percent had been imported.

On easing restrictions in manufacturing or enforcing intellectual property, Xi offered few details and only vague timeframes. Most importantly, he didn't address a core U.S. concern — China's industrial policies.

So it remains to be seen whether Xi's speech was enough to appease the Donald Trump administration.