Employers appear to be using proceeds from corporate tax cuts to continue the practice of rewarding shareholders and executives over workers.

In the first quarter of 2018, corporate America dedicated $305 billion to stock buybacks and cash takeovers compared with $131 billion in pretax wage growth, according to TrimTabs, which compiles market and economic data and operates an ETF that focuses on firms with high levels of free cash flow.

"The recently enacted corporate tax cut is likely to deliver far more benefits to top management and investors than to typical American households," said David Santschi, director of liquidity research at TrimTabs.

"Even before the tax cut, U.S. companies were spending far more money on cash mergers and stock buybacks — actions that tend to boost disproportionately the compensation of top management — than on hiring new workers and paying existing workers more," he added.

The early tally continues a trend that has seen companies commit $4.9 trillion over the past five years to buybacks and deals — "financial engineering," as TrimTabs puts it — and $2.3 trillion to wage increases. If the first-quarter numbers were extrapolated over a five-year period, they would show $6.1 trillion in buybacks and deals to $2.6 trillion in wages, or only slightly above the previous five-year pace for worker raises.

TrimTabs studies money flows to make investing recommendations.

Santschi expects the buyback numbers to accelerate as companies get through what is likely to be a blockbuster first-quarter earnings season. companies are projected to show that profits rose 17.3 percent for the three-month period.

How companies spend the tax cut windfall has formed the cornerstone of the debate over how much benefit the reduction in corporate and personal rates will have for the economy. The dispute is over whether companies will invest the windfall back into the broader economy or just make well-to-do shareholders better off.

Critics say the tax cuts, coupled with a break on the $3.5 trillion that companies have stashed overseas, will be used primarily to dole out share buybacks and dividends. But some say that ends up helping workers as well by raising company share prices and boosting overall wealth in the economy.

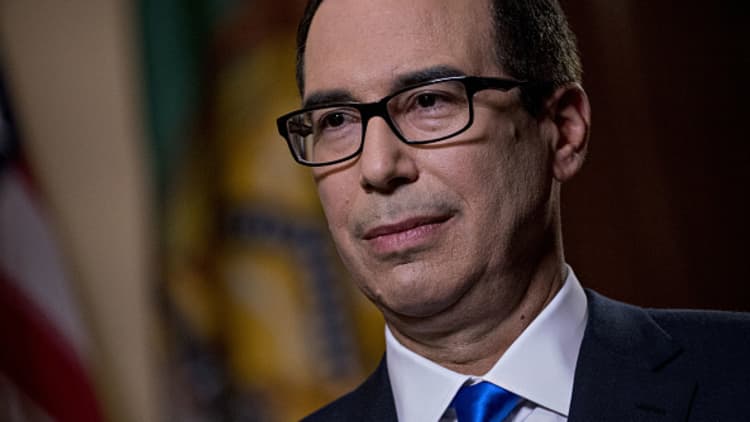

Treasury Secretary Steven Mnuchin, in a CNBC interview Tuesday, however, said the tax cuts have resulted in "people investing large amounts of money back into the United States." Indeed, much of the argument in favor of buybacks and dividends is that it puts money into investors' pockets, which then generates growth.

"Maybe it becomes tangible to consumers and they do spend somewhat, but I don't think it's a big support for economic growth," said Gus Faucher, chief economist at PNC. "It's wealth that already existed, so it's kind of a change in the distribution of wealth, so I don't think it has much of an impact."

At the current pace, the money spent on mergers and buybacks would total $1.22 trillion for all of 2018, Santschi said.

"Companies are highly unlikely to spend anywhere near $1.22 trillion hiring and paying existing workers more this year," he added.

WATCH: Mnuchin says tax cuts aimed at economic growth