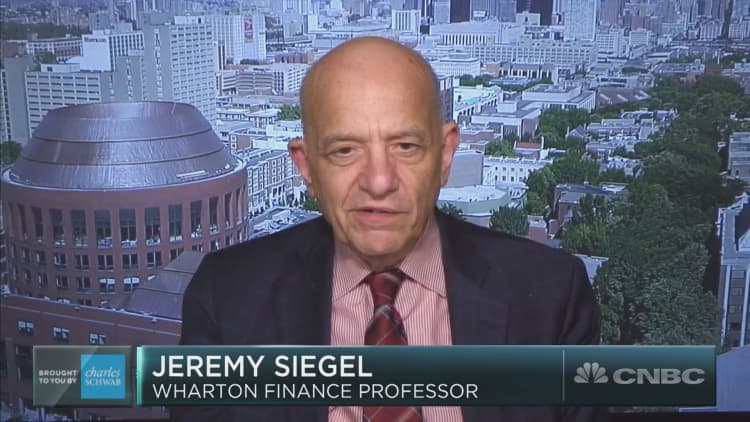

Long-term bull Jeremy Siegel, who correctly predicted 2017's historic rally, isn't convinced strong earnings will push stocks back into record territory.

The Wharton finance professor sees anemic returns compared with last year.

"It's going to be a flat to slightly upward tilting year as good earnings collide with what I think will be higher interest rates both by the Fed and in the Treasury market," he said Monday on CNBC's "Trading Nation." "This market is going to struggle this year."

Siegel predicts the Federal Reserve's plan to shrink billions of dollars of Treasury holdings will put pressure on the market.

It comes as the Fed continues its interest rate-hike policy. According to the latest CNBC Fed Survey, Wall Street is expecting three rate hikes this year.

"Three-point-two-five percent on the 10-Year [Treasury] will give stocks a pause in 2018," Siegel said. Current rates hovered around 2.82 percent.

His best-case scenario is a stock-market gain of no more than 10 percent. Last year, the Dow surged 25 percent.

"These gains that people are talking about — 10 to 15 percent a year this year and maybe next year, I just don't think they're going to be realized," Siegel said.

With just under 10 percent of companies reporting first quarter earnings, 71 percent of the reports have come in above estimates. As of Monday's close, actual reported earnings per share are up 33 percent versus first quarter 2017.

Despite the encouraging numbers, Siegel believes this year's benefits from the corporate tax cut will wane.

"Firms are actually going to lose depreciation deductions in future years. So, it's going to be great in 2018," he said. "2019 — you're going to have to have a growing economy to generate earnings gains. It's not going to be anywhere near as easy as it was this year."

But Siegel wants to make one thing clear: He's not a bear.

"I'm not predicting a bear market. Valuations are still very attractive for long-term investors. We're selling around 18 times this year's earnings," Siegel said. "I wouldn't sell out there."

--CNBC's Juan Aruego contributed to this article.