Rising interest rates and inflation worries could hang over the stock market in the coming week, as investors look to a big flood of earnings news to lift some of their anxiety.

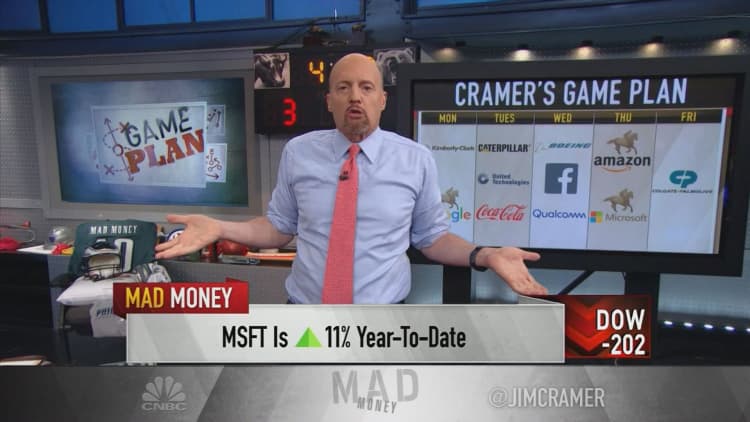

About a third of the S&P 500 companies report in the coming week. It's a diverse mix from a cross-section of industries, including Facebook, Amazon, Visa, Caterpillar, Coca-Cola, Verizon, Boeing, Bristol-Myers Squibb and ExxonMobil.

The S&P 500 was up about a half percent in the past week, but down 0.9 percent Friday, to 2,670, and earnings have so far not provided the expected boost. Strategists say the forward comments just aren't strong enough, and some companies disappointed in other ways, such as Goldman Sachs, which did not announce a stock buyback.

"This was going to be the panacea for the market. This was going to give the market the solid footing to move toward the year's highs," said Quincy Krosby, chief market strategist at Prudential Financial. "I think investors want to see more. Next week, we'll have a broader swath of earnings from all sectors, and we need to focus on the tech sector."

Rising interest rates spooked the market, and the benchmark 10-year Treasury yield late Friday broke to 2.96 percent, the highest level in four years and just below the key psychological 3 percent level.

"[3 percent] wouldn't shock me at all," said Michael Schumacher, director of rates strategy at Wells Fargo. "You think about the moves in the last few days. Hitting another four basis points would not be a big deal. I think 3 percent is a big deal. That's when the casual observer picks up a mainstream publication and says, 'Hey, I didn't realize yields were this high.'"

Interest rates have been rising as a group of Federal Reserve officials sounded a hawkish tone in the past week by simply reinforcing the Fed's message that it intends to raise interest rates and it expects inflation to pick up. At the same time, inflation expectations are rising as commodities gain on tariff issues and other factors.

There's a brisk calendar of economic data, including existing home sales Monday, durable goods Thursday and first-quarter GDP Friday. According to CNBC/Moody's survey of economists, the consensus forecast for first-quarter growth is 2.2 percent, with a big bounce forecast for the second quarter, at 3.7 percent.

But the first quarter is typically weak, and Barclays economists Friday slashed their forecast to 1.5 percent for first-quarter growth, in part on that seasonal factor.

"We think some of that is likely to show up. That's only part of the reason for the weakness. Some of the weakness seems to be in the data itself," said Pooja Sriram, Barclays U.S. economist.

"Our sense in a lot of household data we received through the quarter shows that household spending is weak on durables," said Sriram. "We are expecting higher inventory accumulation in Q1. ... In a sense the weakness is likely to be transitory. It's a soft patch, and we're expecting it to pass. Also something that's likely to support Q2 and Q3, we're expecting to see some of the effects of fiscal stimulus to kick in."

As stocks sold off in the past week, major indexes fell through their 50-day moving average, watched as a sign of momentum on price. That, a sell-off in Apple and the move up in yields soured the mood Friday.

"The cycle's been so long and we've been low for so long that we make the assumption there's a flood of money that's going to come out of equities to get 3 percent for 10 years," said Art Hogan, chief market strategist at B. Riley FBR. The market has been ignoring interest rates for weeks, since a move up in yield sent stocks spiraling lower in February.

Hogan said the market is also concerned that earnings are peaking, but the numbers still look good. "Next week, this will be the onslaught. So far, so good. We expected 17 percent [earnings growth]. Right now we're running in the low 20s. We expected 7.5 percent revenue growth, but we're running at 9 percent," he said.

Hogan said the most frequently mentioned item companies discussed on their earnings conference calls was the positive impact of the weak dollar.

"I thought it was going to be something about trade. That's my concern. You have these blowout earnings, and you may start hearing about higher input costs," said Hogan. He said aluminum and steel tariffs and sanctions on Russia related to aluminum and other metals were driving up prices and inflation jitters.

What to Watch

Monday

Earnings: Alphabet, UBS, Kimberly-Clark, Barrick Gold, Hasbro, SLM, Owens-Illinois, Ameriprise, Canadian National Railway, FirstEnergy, TD Ameritrade, Cadence Designs, Crane

9:45 a.m. Manufacturing PMI

9:45 a.m. Services PMI

10:00 a.m. Existing home sales

Tuesday

Earnings: 3M, Coca-Cola, Caterpillar, Biogen, Amgen, Capital One, Equity Residential, Travelers, United Technologies, Corning, Fifth Third, Freeport-McMoRan, PulteGroup, Eli Lilly, Verizon, Lockheed Martin, JetBlue, Six Flags, Chubb, Boston Properties, Illumina, Trustmark

9:00 a.m. S&P/Case- Shiller home prices

9:00 a.m. FHFA

10:00 a.m. New home sales

10:00 a.m. Consumer confidence

Wednesday

Earnings: Boeing, GlaxoSmithKline, AT&T, Viacom, Comcast, Facebook, Twitter, General Dynamics, Norfolk Southern, Anthem, Credit Suisse, Dr. Pepper Snapple, Nasdaq OMX, Boston Scientific, Northrop Grumman, Visa, Ford, Samsung, Qualcomm, Advanced Micro Devices, Aflac, Chipotle Mexican Grill, Cheesecake Factory, Boston Beer, Morningstar, Sirius XM, PayPal

Thursday

Earnings: Amazon.com, Microsoft, Intel, Bristol-Myers Squibb, ConocoPhillips, Pepsico, Starbucks, Southwest Air, UPS, Union Pacific, Time Warner, General Motors, Barclays, Deutsche Bank, Fiat Chrysler, Volkswagen, Dunkin Brands, Illinois Tool Works, CME Group, Nintendo, Hershey, Nokia, DR Horton, Spirit Airlines, Tractor Supply, Brunswick, Marsh and McLennan, Air Products, Discover Financial, Expedia, Mattel, Lattice Semiconductor, U.S. Steel

8:30 a.m. Initial claims

8:30 a.m. Durable goods

8:30 a.m. Advance economic indicators

10:00 a.m. Housing vacancies

Friday

Earnings: Exxon Mobil, Chevron, TransCanada, Phillips 66, Autoliv, Tenneco, Honda Motor, Sanofi, Colgate-Palmolive, Charter Communications

8:30 a.m. Real GDP Q1

8:30 a.m. Employment cost index

10:00 a.m. Consumer sentiment

WATCH: How to trade tech into earnings