Chip stocks soared Thursday on the heels of positive earnings from Qualcomm and Advanced Micro.

Some traders expect the rally to get even hotter when blue-chip behemoth Intel reports Thursday after the bell.

Intel is set to report first-quarter earnings after the bell on Thursday, and the options market is implying a 5 percent move in either direction on the results. According to Dan Nathan of RiskReversal.com this type of move to the upside would give a much needed boost to the chip trade.

"Intel's report can't come quick enough for the semiconductor space," Nathan said Wednesday on CNBC's "Fast Money" The SMH semiconductor ETF has been flailing lately, down around 14 percent from recent highs.

Additionally, Nathan pointed out how upbeat reports from other chipmakers like Advanced Micro and Qualcomm "should help [overall] sentiment and the space."

Intel, the largest holding in the SMH, saw two times the average daily call volume on Wednesday. Nathan cited the company's strong performance and a recent buy rating from Citigroup for the surge in investor optimism.

"This is a stock that's massively outperforming its semiconductor peers," Nathan said, "It's up [13] percent on the year."

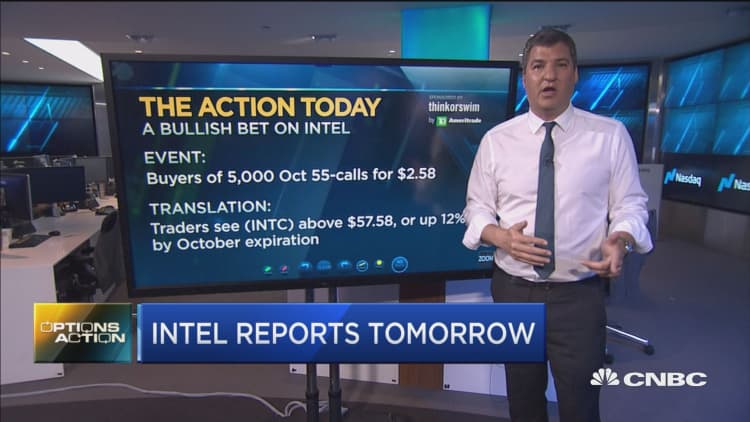

On Wednesday, a block of traders bought the October 55-calls for an average of $2.58 per contract. These are bullish bets that shares of Intel will hit $57.58 or a move of more than 10 percent above current levels by October expiration.

Shares of Intel are up more than 40 percent in the past year but have recently struggled to surpass their highs around the $54 level. However, Nathan says options traders are optimistic for a breakout.

"This is a company that's obviously made a ton of acquisitions over the last few years," he said, "They're positioning themselves for the next 10 years."

Referring to a 20-year chart, Nathan illustrates how despite Intel's 156 percent gain in that time period it's one of the few mega-cap tech stocks that has yet to hit a new all-time high. Nonetheless, he believes the stock could now be poised for a catch-up.

"To me when you have a [big bank] like Citibank coming out and saying we could see $70 maybe $80 in this stock, and it's trading 13 times, this is what I think traders are going to pile into," Nathan said.

Intel's shares were up at around $52.25 on Thursday afternoon.