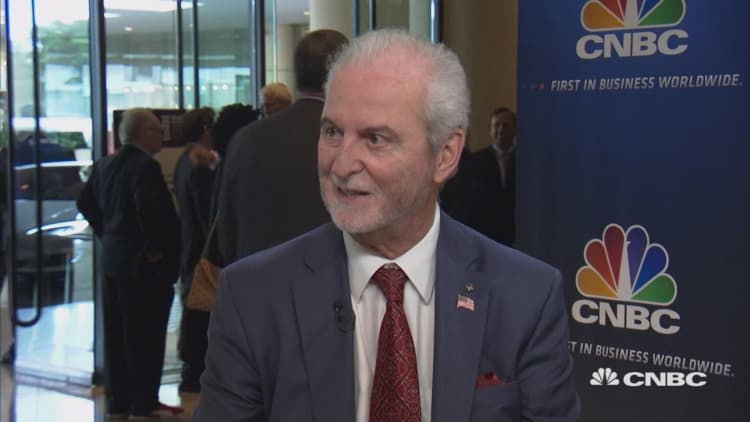

The Trump administration's focus on deregulation and the return of rising interest rates should benefit financial and banking stocks, according to Calamos Investments founder and chairman John Calamos Sr.

"I'm not overly worried that the interest rates start to go back to normal. We forget that if interest rates were more normal, banks would be doing better," he said during an interview with CNBC on Tuesday from the Milken Institute's global conference. "If the banks had the ability to be loaning out more money, especially the smaller and mid-sized banks: that creates jobs. That's what's been lacking over the last 10 years."

Calamos' comments came amid a return to historical levels of volatility in equity markets after an unusually calm 2017. Despite extremely wide swings and days with 1,000-point Dow Jones industrial average losses, stock strategists have remained largely confident stocks will ultimately adjust to rising interest rates.

That process has been turbulent thus far, with the yield on the benchmark 10-year note topping 3 percent for the first time since 2014 last week and sparking a new round of uncertainty in the middle of earnings season. But, Calamos said, significant deregulation – a top priority of President Donald Trump's administration – could help ease the transition back to higher borrowing costs.

Members of Congress are working to adjust aspects of the Dodd-Frank regulatory overhaul, which was passed in the aftermath of the financial crisis in an effort to tighten the behavior of a banking industry blamed for much of the economic instability.

In March, the Senate voted to ease regulations on all but the largest banks, which would raise the level at which banks are considered "systemically important" and exempts smaller banks from other rules aiming to curb risky behavior.

This deregulation "is a tailwind for growth in the economy and I hope that continues. The worst economies in the world are going to be the ones that are over-regulated," Calamos said. Investors should see appreciation in financial and bank stocks, he explained, but other industries – like food and health care could see upside as well.

Calamos, now in his seventies, took his mutual fund public in 2004 after decades of managing money outside the public sphere. His fund is often associated with growth equity as well as convertible bonds.