Shares of Applied Materials fell sharply Friday after the company lowered its current-quarter revenue and sales projections in its semiconductor business below Wall Street expectations.

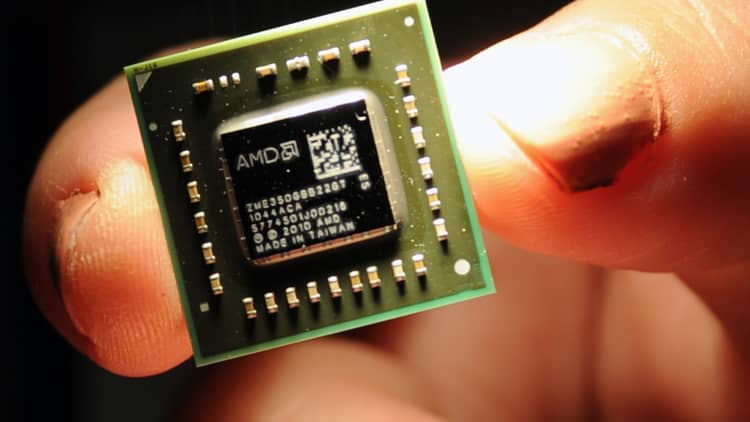

At one point, shares of the company, one of the globe's largest supplier of tools used by chipmakers, tumbled more than 9.5 percent Friday, on track for its worst day since February 2009. By early afternoon, it was down 8.2 percent.

Its disappointing forecast only fueled investor anxiety that a plateauing smartphone market could finally curb demand for flash memory chips.

"Smartphone sales have been below expectations, particularly for high-end models. And in response, both semiconductor and display suppliers have made adjustments to their capacity planning," CEO Gary Dickerson told investors on Thursday's earnings call.

Applied Materials said it expects semiconductor sales revenue to grow 7 percent in the current quarter, well short of the 13.8 percent boost expected by the Street, according to FactSet.

As a barometer for the rest of the industry, Applied Materials' top customers include other large multinational companies like Samsung Electronics, Micron and Intel. Micron and Intel shares also fell Friday.

The disappointing guidance drew critical comments from Goldman Sachs analysts, who downgraded the company's shares to neutral from buy on Friday.

"We downgrade Applied Materials from buy to neutral as we reduce our estimates and price target to reflect the underwhelming market share outlook in the core Semi Cap Equipment business, worse-than-feared fundamentals in Display, and a muted gross margin outlook," analyst Toshiya Hari wrote.

Hari, who emphasized Goldman remains "constructive" on Applied Materials' competitive positioning, nonetheless cut the company's price target to $58 from $65, implying 7 percent upside over the next 12 months.

Despite the lackluster guidance, Applied Materials did post second-quarter results that beat consensus expectations and offered upbeat comments looking forward for the business as a whole.

The company reported adjusted earnings per share of $1.22 versus expectations of $1.14, while revenue of $4.57 billion topped forecasts of $4.45 billion.

"The Internet of Things, Big Data and Artificial Intelligence will disrupt and transform virtually every industry and area of the economy over the next decade," Dickerson added in the earnings call. "While we're only at the very beginning of the buildout of the AI big data era, we are already starting to see the positive impact on our markets."

—CNBC's Michael Bloom contributed to this report.

WATCH: AMAT beats the Street