A key member of the has fired a not-so-subtle warning to Germany over the central bank's independence.

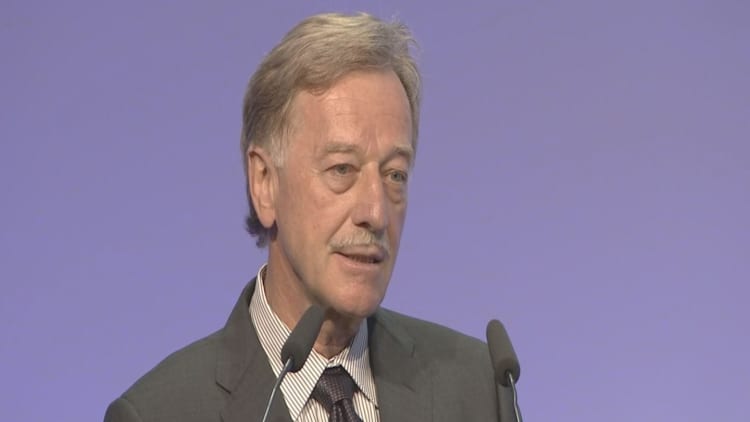

Yves Mersch, an executive board member of the ECB's monetary decision-making body since 2012, told the Frankfurt Finance Summit Tuesday, that the ECB's flexibility and autonomy should not be challenged.

"If some countries want now to have an extensive amount of constraint and limitation on how we exercise our monetary policy powers, this will be an attack on the independence of the central bank," he told the audience.

"I hope this is well understood even in the largest country in Europe," he said to the German audience, ad-libbing from prepared remarks.

The most vocal critics of the ECB's easy monetary policy in recent years has come from within Germany. Bundesbank President Jens Weidmann has consistently criticized the slow normalization of asset purchases and interest rates in the region.

Luxembourg-born Mersch was giving a speech in order to outline why the ECB needs new policy tools if it is to supervise firms that clear financial transactions denominated in euros.

Most of those transactions are cleared through central counterparties (CCPs) currently based in the United Kingdom. This poses a potential oversight problem once Britain exits the European Union in March 2019.

Mersch said CCPs are crucial to a financial system's liquidity and any failure on their part could lead to contagion and bank failures.

The ECB currently does not have the power to regulate the activity of securities clearing systems, including CCPs. To address that problem, it is now looking to amend Article 22 of the "Statute of the European System of Central Banks and the European Central Bank."

Mersch warned that any changes to Article 22 should not result in a list prescribing what the ECB can and cannot do to tackle its main target of price stability.

"We cannot open a Pandora's box and end up in a situation where monetary policy is no longer shielded against political influence," Mersch said.

The ECB member would not be drawn on which country in the future will host the majority of the euro-denominated clearing business. He said "the market will take care of that" while it was the ECB's job to provide clear laws.