Bond market volatility is on the verge of a comeback, according to Sit Investment Associates' Bryce Doty.

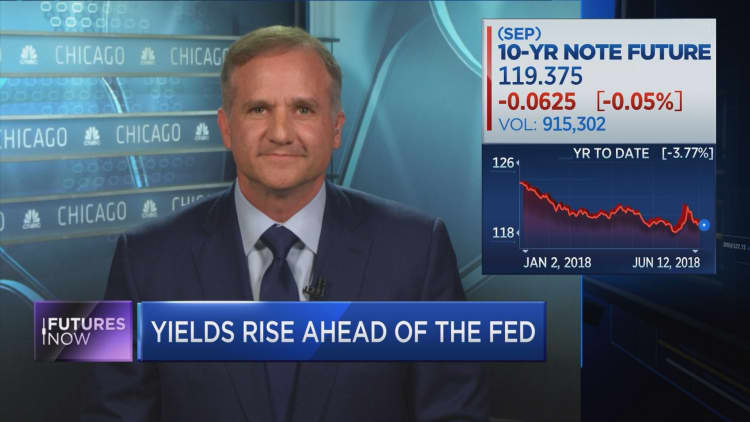

On CNBC's "Futures Now," Doty predicted the 10-year Treasury yield won't stay under 3 percent much longer.

"It's going to be kind of turbulent," the senior portfolio manager said Tuesday. "I'm still expecting some more white-knuckle moments."

Doty closely follows rising rates because he runs the firm's Rise ETF, which is designed to profit from them. According to Morningstar, the ETF is up 3 percent this year.

His thoughts came as June's two-day Federal Reserve meeting on interest rates got underway. Doty believes the Fed, as expected, will hike rates by a quarter point on Wednesday.

He sees yields going nowhere but higher as the central bank sticks with its tightening policy.

"We keep making new highs every time the yield spikes on the 10-year. I just think that's going to continue," said Doty, whose firm has $14 billion in assets under management.

After hitting a four-year high of 3.003 percent on April 24, 10-year yields softened and are now trading around 2.9 percent. They began the year at a benign 2.4 percent.

"I think the 10-year note at the end of the year is going to be between 3.5 and 4," he said. "It's probably not until 3.5 percent on the 10-year where it really starts to hurt the economy."

He's predicting that housing, in particular, could soon get caught in the crosshairs.

"If mortgage rates get up over 5, 5.5 percent, that really starts to hit the real estate market. And, that's where you need to be nervous," Doty said.