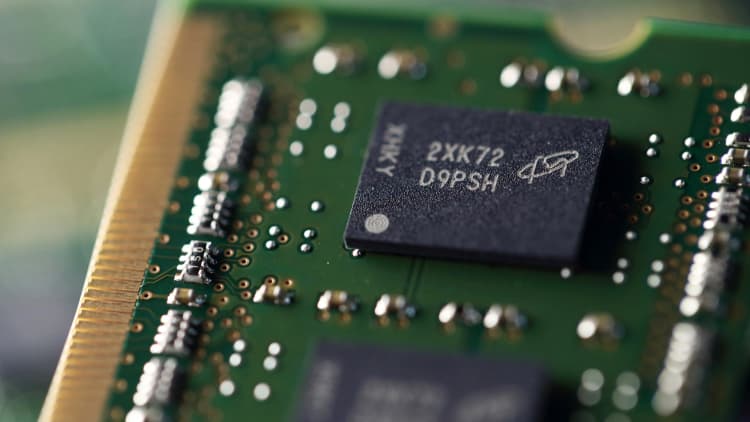

J.P. Morgan believes Micron shares can go higher even after its stunning rally.

The firm reiterated its overweight rating for the chipmaker's shares, citing strong demand for memory chips in the cloud computing market.

"Stay long Micron heading into earnings. We see further upside in Micron shares as the team is executing well in an overall constructive S/D [supply/demand] memory environment," analyst Harlan Sur said in a note to clients Monday. Memory "demand fundamentals likely to remain strong driven by robust cloud data center spending."

Sur reaffirmed his $82 price target for Micron shares, representing 41 percent upside to Friday's close.

The analyst said J.P. Morgan's recent survey of chief information officers suggested cloud computing workloads will quadruple during the next five years. He noted that Micron said cloud computing capital expenditures will triple by 2021 due to artificial intelligence market demand.

"Longer term, the company's increasing product (DRAM, NAND, NOR) and end-market diversification should dampen revenue/earnings volatility and also position the company to do well in markets (handset) that require multiple types of memory," he said.

Micron is scheduled to report its third-quarter earnings results on Wednesday.

The company's stock is up 42 percent this year through Friday versus the S&P 500's 4 percent gain.