The era of the Federal Reserve approving what banks can return to shareholders in the form of dividends and stock buybacks should end, former Wells Fargo CEO Dick Kovacevich told CNBC on Thursday.

"We're a free enterprise system. There's lots of capital in the system now, and banks should be allowed to return what they think is appropriate with a reasonable amount of reserves for recessions and so forth," he said in an interview with "Closing Bell."

The Fed tests banks with a minimum size of $100 billion of assets — a new, higher level this year — on their ability to withstand another economic crisis.

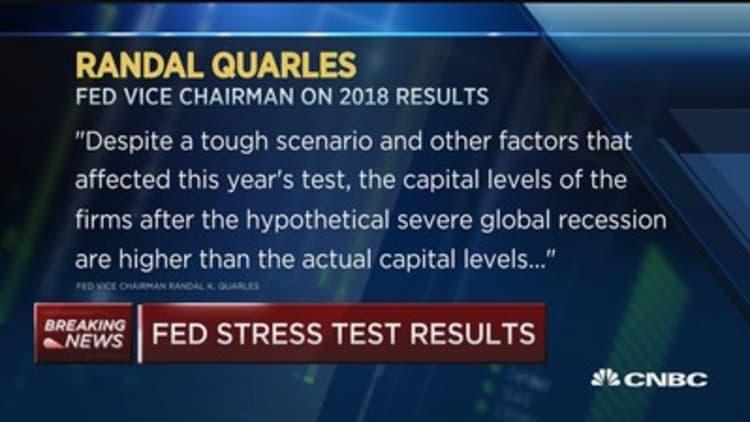

The latest stress test results were released on Thursday afternoon. While 38 banks underwent examination, three were excluded because they did not hit the new $100 billion threshold. The remaining 35 banks were found to have sufficient capital.

But what investors are really waiting to find out is what banks can pay out in dividends and in buybacks, which will be revealed next week. The Fed will either approve or disapprove of the banks' plans.

The tests are a result of the Dodd-Frank reforms instituted in the wake of the financial crisis.

Kovacevich acknowledged there are risks with banks deciding what to return to shareholders.

"If you're wrong, you may get in trouble. But, hey that's capitalism," he said.

Tom Brown, founder and CEO of Second Curve Capital, is "all in favor" of getting rid of the Fed's stress tests.

"We'd go back to what we had before. We had capital standards," he told "Closing Bell."

However, there is one big difference from the old standards — there is now a liquidity test on the banks as part of Dodd-Frank, said Brown.

And that's more important than capital, he noted.

Jeffrey Harte, principal at Sandler O'Neill, agrees.

"Banks failing is all about liquidity. The liquidity-coverage ratio goes a long way to removing the next financial crisis," he said. "That's really what people should be looking at beyond just what the capital levels are as to how safe the bank system is. It's really awash in liquidity right now."

— CNBC's Liz Moyer contributed to this report.