The U.S. economy is bounding along but economic forecaster Lakshman Achuthan sees evidence of a global slowdown in an unlikely place: Demand for cow hides.

Achuthan, co-founder of Economic Cycle Research Institute, says hides and other non-exchange-traded sensitive industrial materials such as rubber are often the first item on the production line and their price movements are a barometer for economic activity.

"They're super sensitive, they're going to swing and have bigger swings than other things but they're very revealing in terms of direction," Achuthan told CNBC's "Trading Nation" on Friday.

With those issues in mind, the economist said that "it's unambiguous here: we have a slowdown."

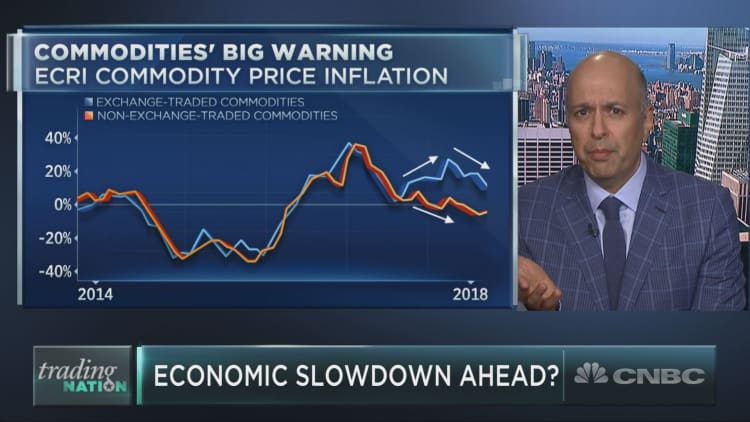

An unusual divergence is occurring in commodities markets is obscuring signs of a global slowdown, says Achuthan. The more closely watched exchange-traded commodities such as oil and copper have spiked on tighter supply from outlier events such as sharp drops in Venezuelan production.

"You had a confluence of kind of shocks on supply, negative supply shocks for things like oil or industrial metals, that all kind of hit at the same time and made it seem like the economy was a bit stronger than it really is," explained Achuthan.

Binary signal

Before this year, the exchange-traded and non-exchange-traded corners of the commodity space typically moved in unison. After splitting, Achuthan now sees that relationship reverting back to normal.

"We were looking for this divergence between these two to resolve itself by the exchange-traded commodities coming back down," he said. "We're getting a binary signal down and the global growth is slowing. That, I think, is becoming apparent especially if you look abroad."

Economic conditions overseas have been deteriorating, including in Europe's largest economy, Germany. Europe's economic locomotive, which accounts for more than a quarter of the European Union's economic activity, recently posted its slowest factory activity in 18 months.

"It's not that there's a recession or anything, but we're certainly slowing," added Achuthan. "When we look at really short-leading indicators including commodity inflation and PMIs and things like that, you're seeing those manufacturing related indicators all edging down. It's not over."

Outside of a bounce in the second quarter, U.S. economic growth is expected to expand this year and contract the next. Economists surveyed by FactSet forecast 2.8 percent growth in 2018 and 2.4 percent in 2019.