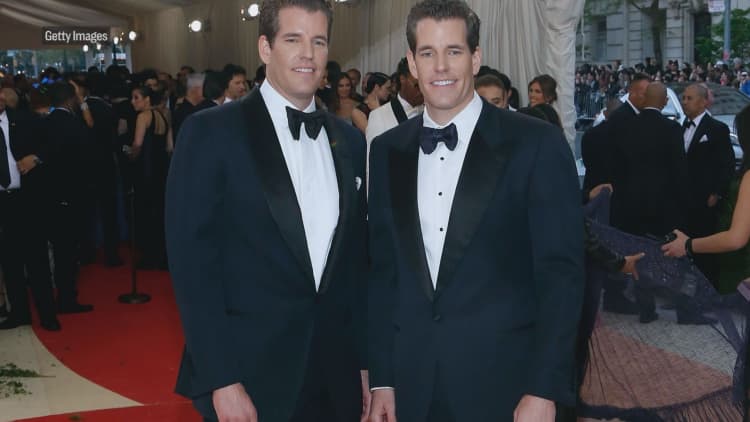

Gemini, a New York-based cryptocurrency exchange founded by brothers Tyler and Cameron Winklevoss, made a significant hire: New York Stock Exchange Chief Information Officer Robert Cornish.

Gemini President Cameron Winklevoss told CNBC in an interview that Cornish will help build out its cryptocurrency platform.

Cornish will be tasked with expanding the range of products that Gemini offers clients with the idea that over time, larger institutional clients such as hedge funds will be investing in cryptocurrencies.

Gemini currently supports a number of cryptocurrencies, including bitcoin, bitcoin cash, ether, zcash and, soon, litecoin.

Skeptics, though, question whether larger investors will want a piece of the action especially given the underperformance in bitcoin and other digital currencies in 2018.

Plus, a number of negative headlines — crypto hacks, phony initial coin offerings, stolen digital wallets — have hurt sentiment.

Bitcoin is currently down 60 percent from its December 2017 high.

But Winklevoss doesn’t see the underperformance in cryptocurrencies stopping the broader cryptocurrency industry from growing and developing new products, saying every asset experiences a bull-and-bear period.

Winklevoss is sticking by his belief in telling CNBC that bitcoin is gold 2.0 and that he sees it becoming a trillion-dollar asset over time.

“Our belief and thesis have stayed the same … we have conviction, and we keep pointing towards the north star and our goal,” said Winklevoss.

The early bitcoin investor says he’s not dissuaded by the day-to-day moves, and in fact is shutting out the noise and focused on investing in Gemini’s platform.

When asked about the recent drop in volume in the bitcoin futures market, Winklevoss admitted that, “It’s been arguably a slower couple of months in terms of trading, but at Gemini it’s been one of the busiest months of our existence as we scale and build. Certainly there’s going to be people in the market that lose their interest. That is what it is.”

Winklevoss’ comments come as the bull vs. bear fight over the future of cryptocurrencies intensifies. Fundstrat’s Tom Lee still sees bitcoin soaring by the end of the year. At the same time, some of Wall Street’s veterans, such as Berkshire Hathway’s Warren Buffett, Charlie Munger and JP Morgan CEO Jamie Dimon, remain overtly cautious.

Meantime, the SEC has dedicated more focus toward cryptocurrenices. Analysts say strong words from regulators in the second half of 2018 could further hurt sentiment but over time provide the regulatory clarity the industry desperately needs.