Tesla's big stock rally after a tweet from CEO Elon Musk that said he is considering taking the company private put an important convertible bond above its conversion price, potentially easing financial pressure on the carmaker.

Tesla shares surged 11 percent Tuesday after a tweet from Musk's verified Twitter account that mentioned taking the company private at a $420 per share price.

The tweet came after an earlier report from the Financial Times that said Saudi Arabia's sovereign wealth fund bought a 3 to 5 percent stake in the electric car maker, according to people with direct knowledge of the matter. That report had already partly lifted Tesla's stock.

Musk later explained in an email to company employees why he is considering taking Tesla private but also said "a final decision has not yet been made." The email was published on Tesla's corporate blog.

Tesla's closing price of $379.57 a share on Tuesday is 5.5 percent above the $359.87 conversion price for the company's $920 million convertible debt due in March, according to a securities filing.

On or after Dec. 1, 2018, to the debt's maturity date, the holders can decide to convert the debt into Tesla shares. If Tesla's stock is above the $359.87 stock price, the holders will likely convert the debt into equity, relieving the company from using $920 million in cash required when the debt comes due in March.

There is no evidence this was Musk's intention with his remarks on Tuesday. Tesla's stock would need to stay above the convert's conversion price level into December for the financial pressure to be eased.

In March, Moody's specifically cited the March 2019 $920 million convertible and the company's cash burn rate as reasons for its downgrade of Tesla's credit rating.

Tesla's skeptics have called into question the state of the company's financial position. It lost nearly $2 billion last year, and so far this year it burned through about $1.8 billion in cash after capital investments through two quarters. The company had $2.2 billion in cash at the end of the June quarter.

Last week, Tesla said in its second-quarter update it will generate positive profits and cash flow going forward absent a severe economic downturn. The company expects its cash balance to grow in the third and fourth quarters. Telsa also guided to GAAP profitability in both quarters.

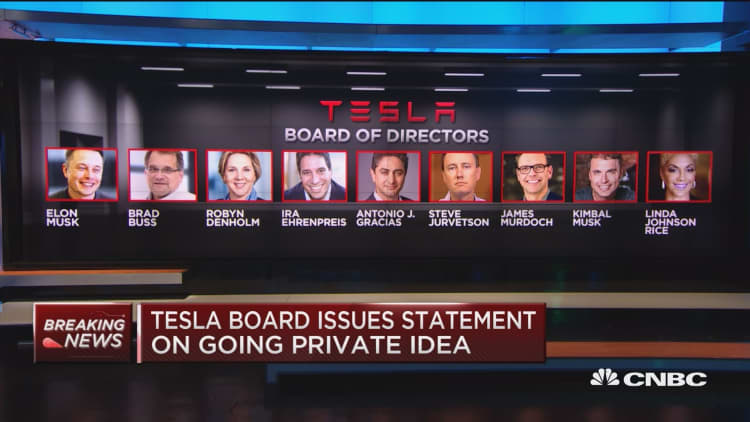

Several members of Tesla's board said in a statement Wednesday the board has met "several times" over the last week to discuss Musk's plan to take the company private.

WATCH: Tesla board evaluates idea of going private