Snap is selling off after a drop in users over its recent quarter. One technical analyst sees its pullback as vindication of his call to avoid the stock.

"We would stay away from this one. We side cautiously," Ari Wald, head of technical analysis at Oppenheimer, told CNBC's "Trading Nation" on Tuesday before the company reported earnings. After it posted earnings, he doubled-down on his call.

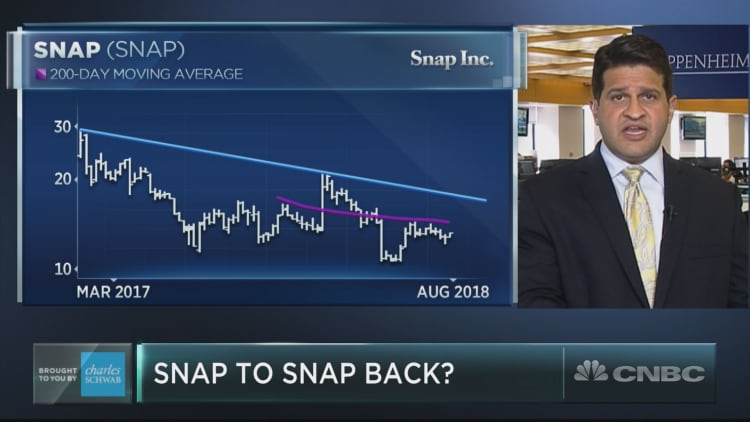

Snap's performance since it debuted in March 2017 has left Wald unimpressed.

"The stock's been making lower highs since it started trading in early 2017. That's against the backdrop of this very strong bull market. I think that's telling," said Wald.

Snap, parent of social media app Snapchat, made its market debut in March 2017. Since then, it's had a bumpy road. It has fallen 23 percent from its IPO price and dropped by nearly 9 percent this year.

"There's resistance at $14.50. If you could get it above there, that would be a sign of technical improvement," Wald said.

A close above that level would be enough for Wald to reconsider his bearish view, but he would not consider a switch to a buy until he sees higher momentum behind the stock.

Bill Baruch, president of Blue Line Futures, backs up Wald's call that a move above $14.50 would be a bullish sign for Snap.

"If it gets above there, you're going to see a move upwards toward $16.50," Baruch told "Trading Nation" on Tuesday. "If this thing does get some momentum, you could look to be a buyer at about $14.50 and ride that to $16.50."

Snap's stock has not traded above $14.50 since April.

Baruch, in an email to CNBC Tuesday evening, said he still did not love the stock even if it moved above $14.50. He said he would need to see Snap rally to hold above that level and then he would consider going long, though with a "tight leash."