Shares of Estée Lauder have fallen more than seven percent in the past three months, but one analyst believes the tide may soon turn.

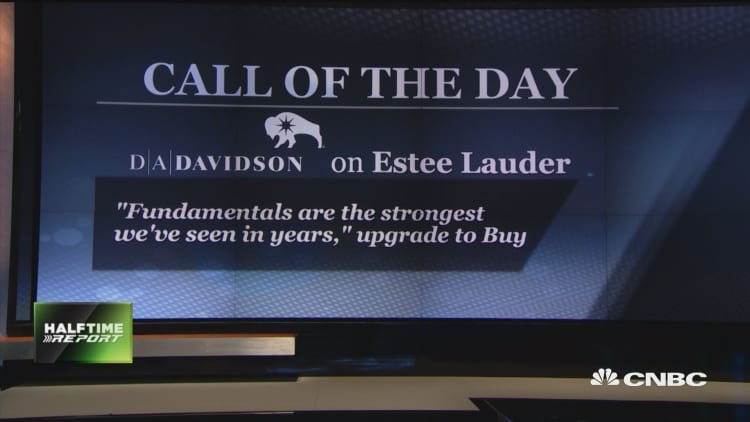

On Tuesday D. A. Davidson's Linda Bolton Weiser upgraded the stock to buy from neutral and raised her 12 -18 month target to $167 -- a 22% upside from Tuesday's close. Estée Lauder's "fundamentals are the strongest we've seen in years," she wrote in a note to clients. She also noted the company's "margin expansion goal" as well as "strong growth in China" as reasons to own the stock.

But not everyone is a believer. "Halftime Report" trader Stephanie Link likes the beauty space and the consumer theme more broadly, but she believes Ulta Beauty is the better bet. A managing director at Nuveeen, which has $970 billion in assets under management, Link recently sold Estée Lauder in favor of Ulta Beauty.

"I sold it [Estée Lauder], took profits. It was a wonderful stock, it just started to trade too expensive for me at 27 times forward estimates," she said on Tuesday's "Halftime Report." "I think Ulta is a much cheaper way of playing that theme. Ulta also has a couple of self-help things happening as well. They've got a restructuring, they've got store growth, they've got new products. In fact they're now selling Estée Lauder's MAC brand, which has really helped drive traffic," she said.

On Monday, Estée Lauder reported Q4 earnings that topped Street estimates for both EPS and revenue. But weak guidance and flat sales in North America sent shares lower.

The stock started the year in the mid $120s and climbed all the way to a new all-time intraday high of $158.80 on June 18, at which point it began to reverse course. It has since fallen 13.96%, as of Tuesday's close, from that high-water mark as investors worry about the company's exposure to department stores amid the continued consumer shift toward e-commerce.

Like Stephanie Link, "Halftime Report" trader Jon Najarian believes investors should wait for a better entry point to buy Estée Lauder. Najarian watches the options market as a way to gauge investor sentiment and capitalize on short-term stock moves. He noted that there was a spike in options activity as the stock began its downward trend in mid-June, and that investors haven't started buying call options again. In other words, traders are not making bullish bets on the stock.

"I think you could be a little patient here rather than jumping in on this one," Najarian argued.

While Link is sticking with Ulta Beauty for the moment, she does believe in Estée Lauder's story long-term, saying "if it were to pull back I would absolutely buy it back."