Markets watchers are buzzing off Tuesday's all-time peak for the tying the record for the longest bull run in history.

But investors shouldn't get carried away, some strategists warned Wednesday as soaring equities are currently unique to the U.S., amid a backdrop of waning returns everywhere else.

This is the position of Ian Harnett, chief investment strategist at London-based Absolute Strategy, discussing what that historic intraday high will mean for market sentiment.

"I don't think it makes any difference at all — I think we're looking at actually the great American bull market," Harnett told telling CNBC's "Squawk Box Europe." "Because if you look outside America, this bull market has already rolled over."

Harnett pointed to a pullback in global equities since the start of the year. Indeed, global equities are down 1 percent, and European equities in dollar terms are down 7.7 percent, with emerging markets down another 7.9 percent. Asia's benchmark MSCI Asia Pacific index has slid about 6 percent since the year's start.

The U.S., by contrast, is up 6.2 percent.

"So, actually, this is fake news — this bull market is fake news because there's a rolling correction that is overtaking markets, currency markets and equity markets, and you're seeing symptoms of this throughout the market space," Harnett said.

Even in sectors where bull market investors normally invest, returns aren't so happy, the strategist said. Mining equities in Europe are down 15 percent in the last three months, for example, and European banks have fallen 30 percent in dollar terms from their late January peak.

"That is a disaster if you've been a high beta, strongly convicted bull in these markets," Harnett said.

America wins

The American market outperforms every time, he argued — even when it triggers the market downturn itself. After the tech bubble burst in 2000, for instance, the U.S. market was once again outperforming its peers within three years.

Why? "Because people go into the dollar, they go back into U.S. assets, they go back into U.S. bonds as well," Harnett said. "So it's very dangerous to get out of the U.S., particularly at the top."

The strategist's message? Stay in American markets and hold.

Wall Street bears, however, are arguing that this market's run isn't sustainable, while others still hold that it has plenty of steam. And there is no consensus on the timing of the market — just as there is little universal consensus on what actually constitutes a bull or bear market.

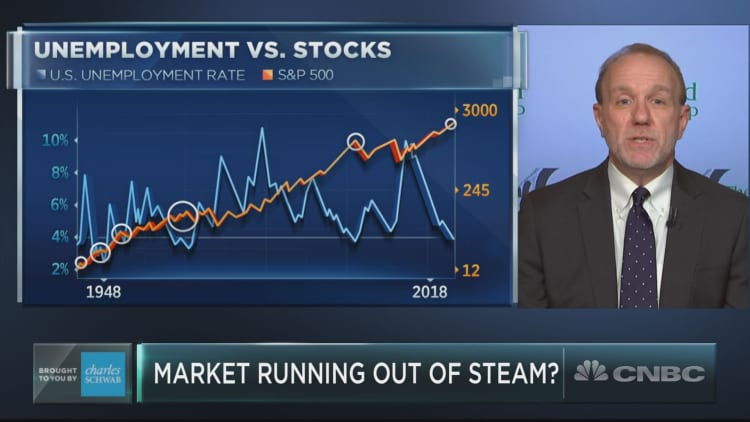

Leuthold Group Chief Investment Strategist Jim Paulsen sees the U.S. market highs as a threat to its own trajectory. He cited historically high market valuations and low unemployment as warning signs, telling CNBC in a prior interview that, "When you run out of the ability to improve things that'll help the market, you've got a market that is up against its upper bounds."

As for the rest of the world, the source of much of its pain — despite a positive picture of global growth recovery in the last few years — can be attributed to U.S. dollar debt. As the U.S. Federal Reserve inches up interest rates in its move away from highly accommodative monetary policy and the dollar strengthens, borrowing becomes more expensive for other countries whose debt is denominated in dollars, particularly emerging markets.

"Dollar debt is strangling the rest of the global economy, and until we get the dollar coming down more aggressively, it's very difficult to actually get global markets starting to reinvigorate," Harnett said. "We worry that the more you push that dollar up, the more stress there is on the global economy."

Jeff Rottinghaus, portfolio manager of the T. Rowe Price U.S. Equity Fund, similarly pointed out "potential risks from slowing economic growth, interest rate hikes ... and the strong US dollar's effect on currency exchange."

"We believe the U.S. is in the later stages of its economic and market cycle," Rottinghaus said. "As a result, we maintain our cautious view on equities."

The S&P 500 hit an all-time high Tuesday, trading above the prior intraday record of 2,872.87 it hit on January 26. After the January high, Wall Street then took a dive and the S&P 500 hit its yearly low of 2,532 during the February 9 trading session. The current bull market is on track to become the longest in history as of Wednesday.

— CNBC's Chloe Aiello contributed to this report.