J.P. Morgan Chase is upgrading an upper-tier checking account with its Sapphire credit-card brand in the hopes that users of the popular card will sign up.

On Monday, the bank will convert Premier Platinum accounts into Sapphire Banking accounts, according to a document viewed by CNBC. The account, which requires $75,000 in total balances or a $25 monthly fee, has perks on top of what the previous version offered. That includes no ATM fees and no foreign exchange fees for overseas ATM and debit-card purchases and waived fees for wire transfers. Similar to the Sapphire cards, membership includes access to entertainment events and lounges.

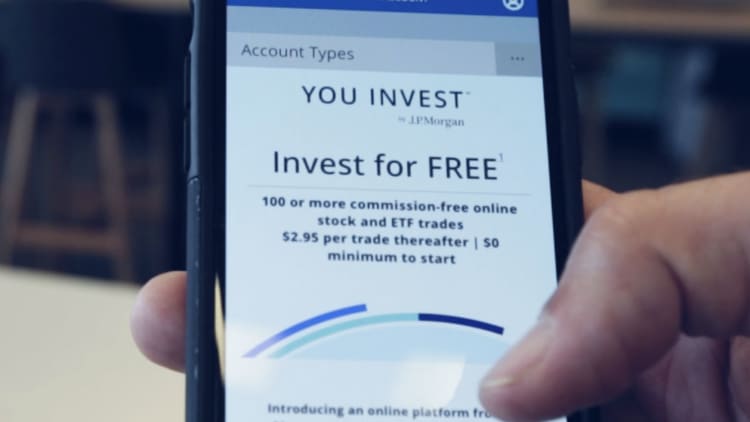

Sapphire bank accounts will also include unlimited free trades on its new investing service You Invest, which is a step up from the 100 free trades that holders of lower-tier accounts qualify for. Brokerages including TD Ameritrade and E-Trade sank in New York trading on Aug. 21 after CNBC reported the bank will offer a new digital investment app with free trading.

Chief Executive Officer Jamie Dimon has cited Amazon Prime and its hodgepodge of free services as the inspiration for the creation of You Invest. Just as with the Amazon membership bundle, the bank will give valued customers an ever-widening list of perks and services to keep them within J.P. Morgan's financial services ecosystem.

J.P. Morgan caused a stir in 2016 with its Sapphire Reserve credit card that came with a 100,000 point sign-on bonus and other lavish perks. While the card has cost the firm hundreds of millions of dollars in rewards liabilities, executives have hinted that they would seek to deepen ties with their new card customers, who tended to be relatively affluent millennials.

"We learned a lot by working with the Sapphire Reserve base," said spokeswoman Trish Wexler. "These are the kinds of customers who care about experiences and simplicity of use more than the interest rate. They want to be rewarded for their relationships."

To convince cardholders to move their deposits from rival banks, though, J.P. Morgan knows that it may take more than waived fees and access to events. The bank is planning on offering a reward-point promotion for the new accounts later this year.

WATCH: JP Morgan to offer digital investment app with free trading