The worst could be yet to come for Italy if its coalition government sticks to plans to increase public spending, according to a vice president at the European Commission.

Italy is due to present its controversial spending plans to the European Commission for approval by midnight Monday, plans which have already caused the government pain in terms of higher borrowing costs.

"At the end of the day it may be counterproductive for Italy's economy, which may now be confronted with sky-high interest rates," Valdis Dombrovskis, the European Commission vice president for the euro and social dialogue, told CNBC's Geoff Cutmore during a panel discussion at the International Monetary Fund meeting in Bali.

"And the government will be confronted with higher debt servicing costs. So this is certainly a factor which also needs to be taken into account when discussing Italy's government's fiscal plans," he said.

Italy's 2019 budget keeps promises made to the Italian electorate on increased public spending and reduce taxes. But breaks promises made to Brussels to target lower public spending and debt.

The plans have already caused confrontations with the powerful Brussels-based Commission, which upholds the EU's spending rules among other things. Although the spending plans envisage Italy's spending within the rules laid out by the executive body, the government has rowed back on previous promises to lower public spending and to target a more balanced budget.

Dombrovskis said the Commission didn't want to sanction Italy for reneging on agreed fiscal terms, however.

"We definitely do not desire to sanction anyone. On the contrary, we are still in dialogue with Italian authorities trying to ensure that the Italian authorities are actually correcting their course," he said.

Higher borrowing costs

Italy's spending plans, and investor fears over financial instability in the country, have already cost Italy dear in terms of its borrowing costs with interest rates rising as traders have become nervous about the country's financial well-being.

The yield (the amount of interest investors demand in return for buying debt) on Italy's benchmark 10-year bond currently stands at 3.556 percent, a month ago it was 2.789 percent. Dombrovskis said "the element of market discipline here is also important."

"Already now the rates of Italian government bonds are depending on maturities of somewhere between 1 percentage points or 1.5 percentage points higher than they were a year ago. So already now we see that (the budget plans are) negatively affecting the debt servicing costs of the government … It also raises interest rates for the broader economy."

According to the Commission's rules, Italy has to present its proposed 2019 budget to it by October 15, midnight on Monday.

Italy's Deputy Prime Minister Matteo Salvini is expected to attend a Cabinet meeting on the budget later Monday afternoon before Italy is expected to submit its controversial spending plans to Brussels.

The office of Economy Minister Giovanni Tria told CNBC's Willem Marx that the draft budget would "very probably" be sent to Brussels before the midnight deadline. Asked if there was a chance the budget could miss the deadline, the spokesperson Laura Sala said, "I honestly don't know."

Higher debt

The coalition government made up of the right-wing Lega party and the anti-establishment Five Star Movement (M5S) have proposed spending plans that see it stick within the European Commission's rules that budget deficits should not exceed 3 percent of gross domestic product (GDP).

Italy's government says its plans, which include implementing a universal income, tax cuts and planned changes to pension reforms, will raise the budget deficit to 2.4 percent of its GDP.

The problem lies in the fact that Italy has rolled back on a previous agreement for its budget to target a 0.8 percent deficit. If Italy raises its spending, it raises its already high debt pile — the second highest public debt pile in the euro zone after Greece, totaling around 2.3 trillion euros ($2.6 trillion) or equal to 130 percent of GDP.

As such, Italy is under pressure from the European Commission to reduce its spending and balance the budget. But the young coalition government is keen to fulfil its spending pledges to voters after the March election.

There have also been mixed messages from Italy — and arguments within the government — about Italy's spending plans. Economy Minister Tria appeared to push for more moderate spending, only to be overruled by Salvini and fellow Deputy Prime Minister Luigi Di Maio.

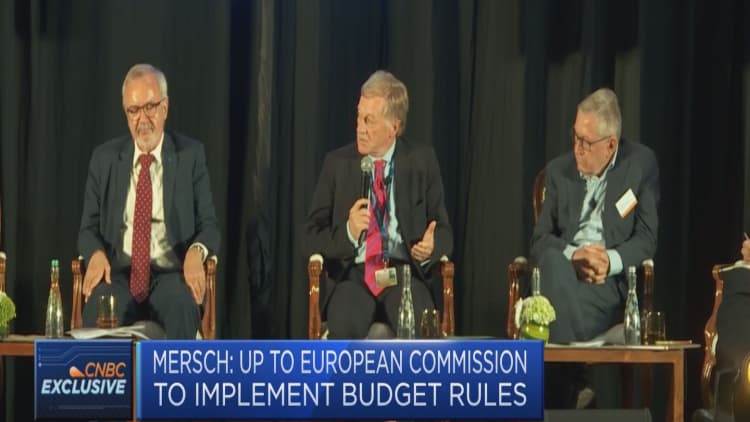

Another member of Europe's governing financial establishment said Italy needed to be clear about its spending intentions. Yves Mersch, a member of the European Central Bank's executive board, also said Saturday that the European Commission needed "the facts on the table" from Italy.

"This is a mandate (with the Commission) where all the rules are public, are transparent and are on the table. And it is up to the Commission to implement them after thorough analysis. But before you can do an analysis you must have facts on the table and not only intentions, or declarations. So, I would refrain from reacting to declarations which go in every direction and which change from one day to another," he said during a CNBC-moderated panel on Saturday.

He likened the tit-for-tat comments between Italy and the Commission to a boxing match.