Credit Suisse reported lower-than-expected net income results for the third quarter of the year, after a challenging summer and increased volatility in emerging markets.

Net income stood at 424 million Swiss francs, a 74 percent increase from a year ago. However, the numbers missed analysts' forecast of 449 million Swiss francs, according to data from Reuters.

Credit Suisse had reported a net income of 244 million Swiss francs in the third quarter of 2017.

Here are some of the key highlights of the third quarter:

- Net revenues hit 4.8 billion Swiss francs versus 4.9 billion Swiss francs a year ago.

- Total operating expenses stood at 4.1 billion Swiss francs versus 4.5 billion Swiss francs a year ago.

- CET 1 ratio of 12.9 percent versus 14 percent a year ago.

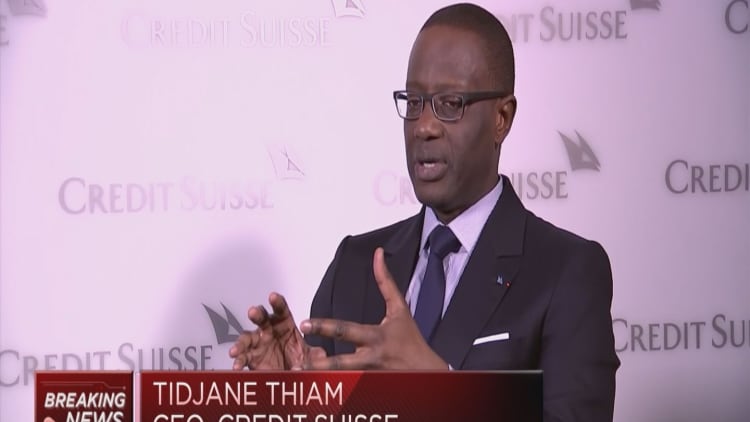

Speaking to CNBC, Tidjane Thiam, chief executive officer of Credit Suisse said the quarterly results were "good" and thanks to the restructuring process, done over the last couple of years, the bank managed to offset different challenges seen in the third quarter.

"I can tell you in a quarter like this, the old Credit Suisse would have lost hundreds of millions…Today we are making a profit," Thiam told CNBC's Geoff Cutmore.

In the financial statement, Credit Suisse explained that the third quarter had "much more challenging conditions and lower levels of client activity."

"The environment was challenging this summer," Thiam said in a statement released Thursday, explaining that apart from the usual seasonal slowdown, increased volatility in emerging markets and in some emerging market currencies led to a drop in client activity.

In conversation with CNBC, Thiam said there is a "disconnect" between economic performance and market sentiment.

"It is a difficult environment, the economy is doing very well…(but) there is a disconnect because the condition of the economy, if you wish, and the psychology, the mindset in markets, which is a bit fragile as I said."

Out of the bank's three main divisions, wealth management continued to deliver the biggest income to the bank. Adjusted income before taxes stood at 411 million Swiss francs from 382 million Swiss francs a year ago.

Shares in Switzerland's second-largest bank are down by more than 24 percent since the start of the year. Thiam told CNBC that he hopes that as the bank continues to show good results, the share price will translate those efforts.

Savings

The Swiss bank said that sentiment turned more negative in the third quarter and warned that it may carry over onto the last quarter of 2018.

However, Credit Suisse said that the outlook for global economic growth in the next three months remains "positive, despite continued geopolitical tensions surrounding global trade and the potential impact of monetary policy changes by central banks."

Going forward, the bank is also confident that it will deliver the cost savings that it had planned for the year, above 4.2 billion Swiss francs.

Shares traded 3 percent lower shortly after markets opened in Europe.