The Dow plunge isn't anywhere near done. At least, not according to chief financial officers at major corporations.

More than half of the members of the CNBC Global CFO Council think the Dow Jones Industrial Average will fall below 23,000 — roughly 2,000 points from its current level — before the stock market barometer is ever able to top the 27,000 level. The 23,000 level would equate to another 8 percent in decline among the Dow group of stocks before the selling stops. The Dow dropped by more than 400 points on Monday.

The CNBC Global CFO Council represents some of the largest public and private companies in the world, collectively managing nearly $5 trillion in market value across a wide variety of sectors. The survey was conducted from Nov. 13–19, 2018.

Just over 51 percent of CFOs taking the survey have come to this pessimistic view of stocks, which represents a high in the CNBC quarterly CFO survey for 2018. When stock market volatility first spiked in Q1, 42 percent of CFOs thought a drop to 23,000 was coming. But 31 percent of CFOs were still of the mindset that a new record above 27,000 was more likely, and the market optimism increased by the third quarter to 50 percent of CFOs believing 27,000 was possible.

Now only a little more than 13 percent of financial officers believe the market will reach a new record before another major drop.

The CFO outlook matches the overall trend in market volatility, with the first quarter and fourth quarter of the year featuring whipsaw activity in stocks. The stocks that have led throughout the bull market, the FAANG technology stocks (Facebook, Amazon, Apple, Netflix and Google, now Alphabet) were all 20 percent off their most recent highs on Monday, a bear market in the market leaders.

Trade is the No. 1 concern

Concerns about a slowing economy — Goldman Sachs said on Monday in a report that U.S. economic growth could be cut in half by the end of next year as the tax cuts wear off and rates rise — and worries about another round of tariffs against China set for January in the ongoing trade war are weighing on the corporate outlook.

Thirty-five percent of CFOs surveyed in Q4 cited trade as their biggest current concern, making it the top issue in the fourth quarters.

CFOs were also asked their opinion of major political figures in Washington, and President Trump's hardline trade advisors, Peter Navarro and Robert Lighthizer, had by far the lowest approval ratings among CFOs, at 26.7 percent. Last week, as stocks suffered another steep selloff, the White House was sending mixed messages on trade, with President Donald Trump's top economic advisor, Larry Kudlow, disavowing comments from White House trade advisor Peter Navarro, who last week lashed out at Wall Street influence in U.S.-China trade negotiations in comments that helped weaken the stock market.

The stock decline on Monday came after a Sunday speech by Vice President Mike Pence saying there would be no end to U.S. charges on $250 billion worth of Chinese goods unless Beijing changed its ways.

Consumer demand was the second biggest risk cited by CFOs, at 24 percent. But it had been the No. 1 concern of CFOs in Q3, and fell off by a considerable percentage as CFO concerns about trade hit their highest quarterly mark in 2018. The percentage of CFOs citing central bank policy as their biggest concern increased slightly, from 10 percent to 13.5 percent, but near-60 percent of CFOs expect the Federal Reserve to raise rates again in December.

While the market volatility is clearly weighing on CFOs, and the political headlines continue to increase uncertainty, CFOs were still mostly positive on the global macroeconomic conditions in Q4, with every region around the globe being rated as "stable." The United States, in particular, was the only region described as "improving," which is a tag the U.S. has received from CFOs taking the survey for eight quarters in a row.

(Note: The CNBC Global CFO Council Survey for the fourth quarter was conducted from Nov. 13–19, 2018. Thirty-seven of the 121 global members responded to the survey, including 15 North America members, 13 EMEA members and 9 APAC members.)

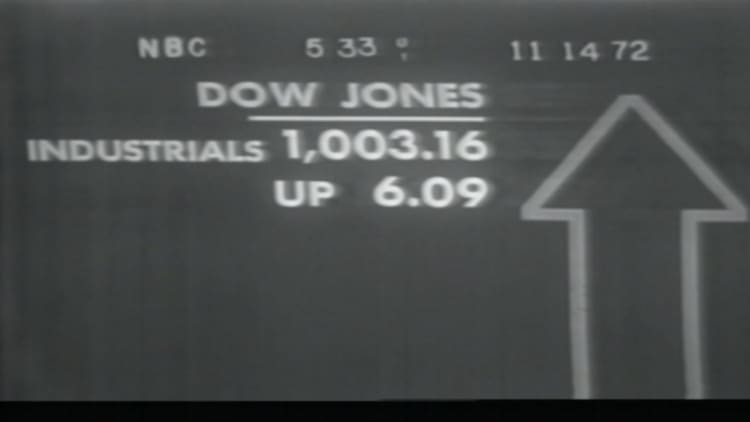

Watch: When the Dow closed about 1,000 for the first time in 1972