Global chip stocks tumbled on Thursday as the arrest of a top executive at Chinese tech giant Huawei renewed fears of an escalation in U.S.-China trade tensions.

Shares of Austrian chipmaker AMS plunged around 7 percent. Switzerland-based STMicroelectronics dropped 4 percent, while the U.K.- headquartered Dialog Semiconductor slumped around 3 percent.

The moves in European stocks followed losses in Asia, where shares of Japanese chipmakers Sumco, Tokyo Electron and Advantest each fell around 5 percent.

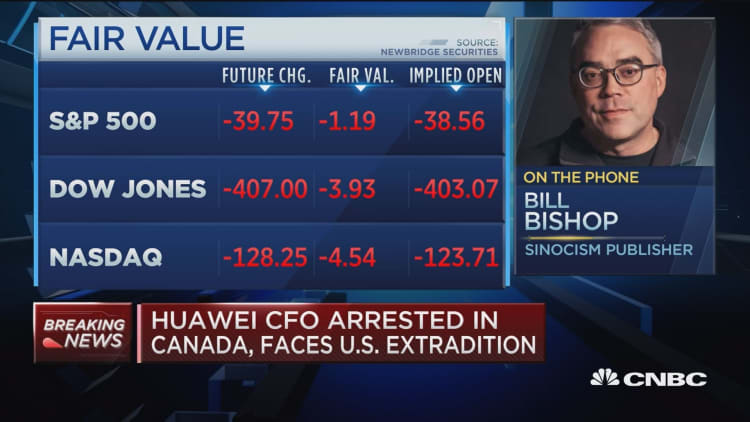

Canadian authorities arrested Huawei CFO Meng Wanzhou on December 1 in Vancouver, where she is facing extradition to the U.S., Canada's Department of Justice said Wednesday. The arrest is reportedly related to Huawei's violation of U.S. sanctions on Iran.

Analysts said uncertainty from Huawei and the broader U.S.-China trade relationship weighed on sentiment in the chip sector. Huawei is the world's second biggest smartphone maker by market share, according to research firm International Data Corporation (IDC).

"It's no surprise, then, that a potential disruption to its business and supplier relations would impact the outlook for a wide set of silicon vendors," Peter Jarich, head of GSMA Intelligence, a research firm, told CNBC in an email Thursday.

Chipmakers that rely on global supply chains have been stuck at the center of the trade war between the U.S. and China. The iShares PHLX Semiconductor ETF surged nearly 3 percent Monday following the announcement of a 90-day cease-fire preventing new tariffs on Chinese and American goods. On Thursday, shares were set to open nearly 3 percent lower as the Huawei news overshadowed optimism about the U.S.-China relationship.

"If a cease-fire is just superficial and really we're going to have this wrangling beneath the surface…that's disingenuous," Grace Peters, executive director of EMEA Equity Strategy at JPMorgan Private Bank, told CNBC Europe's "Squawk Box" Thursday.

Fears of slowing economic growth, higher interest rates and waning smartphone demand are also factors weighing on the chip market. Analysts have recently downgraded their forecasts for Apple chip suppliers amid concerns over weaker-than-expected sales of the iPhone XR.

Tech giants like Samsung and Huawei are increasingly developing their own chip technology, in part to insulate themselves from global supply chain tensions. Samsung was not immune to negative sentiment on Thursday, however, with shares dropping more than 2 percent.

Correction: This story has been updated to reflect that Canadian authorities arrested Huawei CFO Meng Wanzhou on December 1 in Vancouver.