China's push to lead the global development of electric cars is nearing a moment of truth.

Two of the largest start-ups in the industry — both Chinese — launched new passenger vehicles in the last week. The announcements come with less than two years to go before Beijing's subsidies are set to end, and as better-known brands such as Tesla move into the massive Chinese market.

Nio, a $7.9 billion Shanghai-based company listed in New York, announced Saturday its second line of commercially available SUVs will be available beginning June 2019. Prices for the ES6 begin at 358,000 yuan ($51,883), excluding subsidies. That's about 400,000 less than the local price tag for models sold by Tesla, which is targeting the same luxury market as Nio.

In the medium-priced market, Guangzhou-based Xpeng announced last Wednesday that prices excluding subsidies for its first commercially available vehicle, the G3, will begin at 227,800 yuan (about $33,000) with deliveries starting that day.

"Given the size of the market, the Chinese (original equipment manufacturers) have the opportunity to go down the cost curve and build an advantage globally," Pierre-Henri Boutot, a partner at Bain, said in a phone interview last week.

"There is an inflection point coming in 2020," he said, explaining that's when he expects consumers will find battery-powered electric vehicles just as competitive as internal combustion ones from a total cost perspective.

"This change will begin faster in China compared to global(ly). That's a tremendous opportunity for local OEMs," Boutot said.

The question is whether the Chinese players can survive when government subsidies end, or in regions where the state has less influence.

A lot of these start-ups will fade away. Most will disappear.Brian Guvice chairman of Xpeng

Beijing began its subsidies program in 2010 to spur the nascent industry. The central and provincial governments have spent the equivalent of several thousand U.S. dollars per vehicle and encouraged purchasing by eliminating taxes and making it easier to get a license plate. In fact, Chinese government ministries and agencies have had requirements to buy electric vehicles, Scott Kennedy, China expert at the Center for Strategic and International Studies, said in a November report.

Beijing's plan is to end the subsidies by 2020 and it has already begun raising requirements to obtain them, especially as there are concerns of what an official called "blind" development.

Shifting business models

Nio and Xpeng are just two of many Chinese electric car companies that have popped up in the last few years under Beijing's support for the vehicles. Related Chinese government spending has topped 390 billion yuan, or more than 42 percent of commercial activity in the industry, CSIS' Kennedy estimated in his report

So far this year, venture capitalists have poured roughly $6.7 billion into Chinese electric car companies, following investments of $4.8 billion last year and $2.4 billion in 2016, according to Pitchbook data as of Dec. 11. China's largest technology companies have also joined the race. Tencent is an investor in Nio, while Alibaba backs Xpeng, which was valued at $3.6 billion during a fundraising round in August.

The bet is that the start-ups can prove a new business model for the car industry.

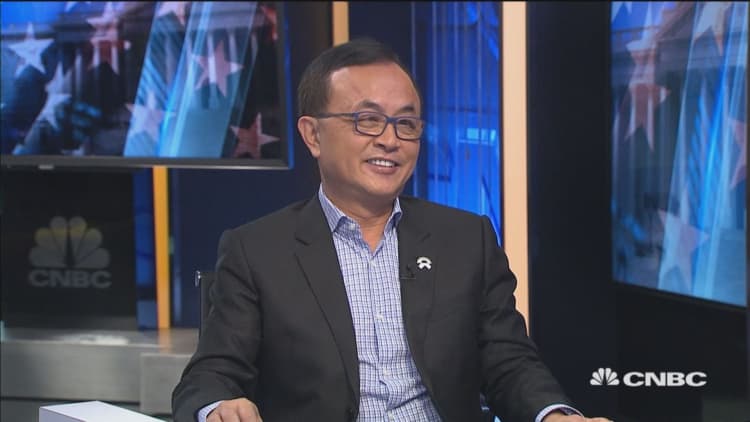

"What the industry needs to change is not just technology, but the industry also needs to change the way in which it interacts with customers. The customer experience also needs to change," William Li, Nio founder and CEO said in Mandarin during an interview with CNBC this weekend. "The number of companies that can achieve these kinds of changes at the same time is very few. I believe our direction is correct."

The company's major selling points are three-minute battery swaps, a fleet of vehicles providing mobile power banks and a network of clubhouses for users, typically set in prime real estate locations in major Chinese cities. The company intends to more than double the number of its "Nio Houses" and pop-up stores to 70 from 26 by the end of 2019.

However, Nio's plans to expand into the U.S. and launch an autonomous vehicle there in 2020 appear to be on the back burner for now. The company announced in late November its U.S. CEO Padmasree Warrior is leaving, effective Dec. 17, for personal reasons.

When asked about the 2020 launch plan, Li declined to confirm a change, but noted that the company has not mentioned U.S. plans since its September IPO.

The opportunity within China remains large. Bain has predicted penetration of battery-powered electric vehicles to reach 18 percent in 2025, and likely top 70 percent by 2040.

Xpeng is trying to differentiate itself with its years-long product development process, lower price tag and integration of autonomous-driving features such as assistance with parking. The company is also rapidly expanding its physical presence from just four locations in southern China to a planned 60 to 70 stores in nearly 30 cities nationwide in the next 12 months.

"A lot of these start-ups will fade away. Most will disappear," Brian Gu, vice chairman of Xpeng, said in a phone interview last week. "I actually believe subsidies may not be good for the market, because it distorts the demand curve. The product itself has to prove itself as a gas engine alternative."

Gu would not share exact sales figures, but said pre-sales have increased nine times from August to November.

As of Dec. 15, Nio said it has delivered 9,726 units of its ES8 SUV since deliveries began in late June. Based on November figures, that means Nio delivered 1,696 vehicles in about two weeks and is on pace to reach its target of 10,000 for the second half of 2018.

"The biggest change for the industry, for Nio, is to cope with a market that is not growing," said Bill Russo, founder and CEO of Shanghai-based consultancy Automobility Limited. "I see the future of mobility (as) increasingly shared."

"The global automotive industry is facing an existential crisis because it has relied on Asian and emerging markets for its growth," Russo added. "China was the growth engine for the global automotive industry. If China becomes a market industry served by electric vehicles, (traditional automakers) have the challenge of investing in the new technology."