You might not want to fly Spirit Airlines, but you probably wish you owned its stock this year.

Shares of the no-frills airline surged close to 30 percent in 2018, as of Wednesday's close, while those of most of its competitors — and the broader market — tumbled. Spirit's shares hit a more than three-year high in early December, and the company is now worth about $3.8 billion after the year's gains.

It grew its profits in the most recent quarter despite a jump in fuel costs and issued a sunny forecast for the end of the year.

But it's not just investors who might be pleased. The airline that long drew the ire of travelers for its customer service and still receives more complaints from customers than most other U.S. rivals is making strides. Its flights are arriving on time.

"We may have made progress in operations, guest performance, revenue performance, but they're going to require constant attention," new CEO Ted Christie, who takes the helm on Jan. 1, said in an interview. "We're a much sharper competitor."

He takes over from current CEO Bob Fornaro, who took the top job in 2016 after Ben Baldanza, the architect of Spirit's menu of fees, left abruptly after a decade in the role.

Christie, a six-year executive of Spirit, is the company's president and was its CFO until October. He said the carrier can please more than just investors, attracting more passengers on board, even with its model of charging for everything from seat selection to overhead bin access to bottled water.

"The messaging is all around about being a high-quality low-fare airline," said Christie.

And Spirit has been improving.

This past October, Spirit vaulted to the top of the Department of Transportation's on-time arrival rankings of major U.S. airlines for the first time. Its flights were on time 81 percent of the time in the first 10 months of the year, the fourth best, up from dead last in the year-earlier period.

Its customer complaints remain higher than its competitors' but have declined in the past few years. The Transportation Department logged 2.46 complaints against Spirit in October for 100,000 enplaned passengers, well above the average of 0.88. But that compares with 3.64 complaints for 100,000 travelers in October 2017 and close to half the rate posted in the same month in 2016.

The airline last year enrolled its customer-facing employees in Walt Disney's leadership and professional training subsidiary, the Disney Institute, to try to improve its interaction with Spirit travelers.

"Before, price was the product," said Savanthi Syth, an airline equities analyst at Raymond James. "Price is still important, but also the reliability is important. They'll never be high-touch like Delta, but just the basics, making sure you get that."

Spirit flew nearly 24 million passengers last year, a more than 13 percent increase from 2016, making it the eighth-biggest airline in the U.S., according to the Transportation Department. The airline is adding capacity more than three times as fast as other airlines. Christie wants to increase its service between the U.S. and Latin America.

When asked whether he would consider merging with another carrier, Christie said he's focused on running the airline but added that "you can never rule out any option."

Spirit's stock rally isn't over, according to some analyst estimates. After Spirit in late November nearly doubled its fourth-quarter revenue forecast to growth of 11 percent, several analysts raised their estimates for its stock price, and the airline blew through some of those targets. Helane Becker, airline analyst at Cowen & Co., called a target price of $60 after Spirit's improved estimates, up from $55 in October. The stock was trading midday Thursday down 3.6 percent at $55.66. Jamie Baker, an airline analyst at J.P. Morgan, upgraded the company's stock to outperform with a target price of $82, close to its all-time high of $84.87, hit in December 2014.

Analysts polled by Refinitiv expect the airline to grow earnings next year by 35 percent.

Spirit is heavily reliant on ancillary revenue, fees for services that often come for free with standard coach tickets on other airlines. In the last quarter it collected close to $55 in non-fare revenue from passengers and $57 per passenger in airfare.

Its model of a low, stripped-down airfare and fees for nearly everything else, which many travelers bristled at years ago, is now more common on big carriers. Delta, United and American have each launched no-frills basic economy fares in recent years.

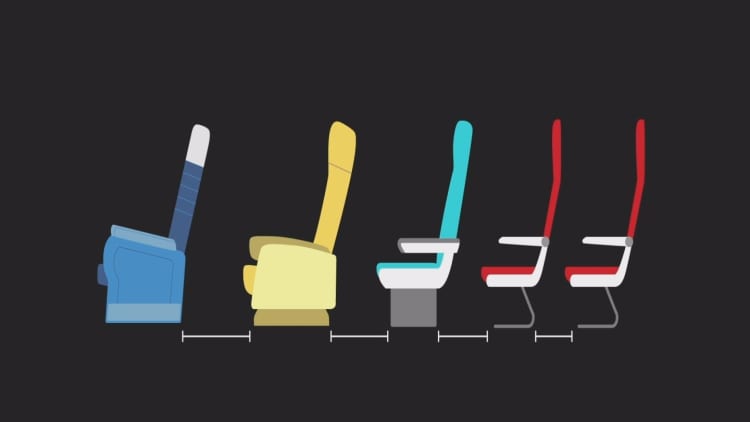

Christie, who is 48 years old and stands 6'2," said he regularly flies in Spirit's 28-inch-pitch seats comfortably. He argues that legroom is an outdated concept because seats are slimmer than they used to be and offer more space.

Christie wants to get more passengers to pay for upgraded services. The airline recently rejiggered its website and app, adding reminders for travelers about the chance to select other services or upgrade to a "Big Front Seat," one of its seats at the front of the plane that has six inches more legroom than the standard seats.

There could be challenges ahead. Concerns about a potential economic slowdown roiled markets in December, and some airline executives are starting to play defense. Delta earlier this month told investors it was prepared for a weaker economy because its revenue streams are more diverse than they had been in the past, to include income from credit card deals.

Christie said he expects the airline is on solid footing because its customers are mostly vacationers, not business travelers, which tend to ebb and flow more with economic cycles. Since the last cycle "it has been a while, thankfully."

Correction: A previous version of this story said Christie is the current CFO. He was the CFO until October.