Constellation Brands' share drop after earnings was a "total overreaction" that made the stock "an absolutely fantastic value," CEO Rob Sands told CNBC's Jim Cramer after the company's fiscal third-quarter report.

The 12.42 percent plunge, which brought the alcohol distributor's shares to a new 52-week low, made the stock so enticing that Sands and his brother, Richard Sands — who serves as Constellation's chairman of the board — bought the stock themselves, the CEO said Wednesday on "Mad Money."

Calling the stock "way oversold," Sands told Cramer that he and his brother acquired 1.1 million shares of Constellation "in the last week or so." According to SEC filings, they each bought stock at $11.85 a share, exercising an option from 2009 that was set to expire this year. That would bring their total purchase to roughly $13 million.

At Wednesday's closing price, 1.1 million shares of Constellation's Class A stock was worth about $166 million.

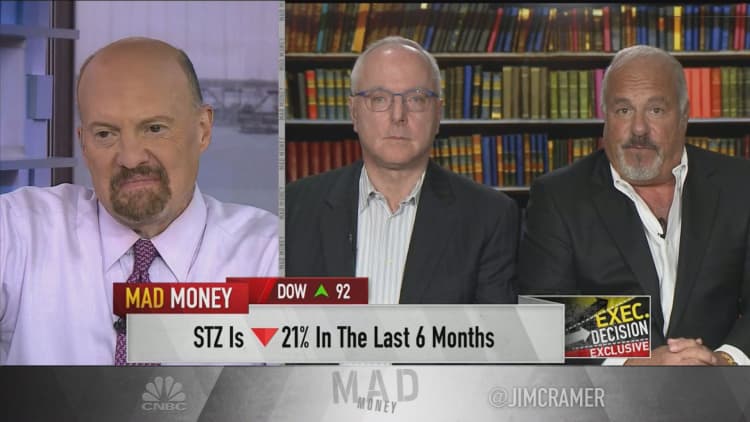

In a joint interview with his successor Bill Newlands, who will take over as CEO in March, Sands also described what he thought was the particular cause of Wall Street's negative reaction.

"It's totally a function of the change in our guidance," he said, addressing the company's roughly 25-cent guidance cut. "And the change of our guidance is also totally a function of ... our anticipating a disappointing year on the wine and spirits side."

But the weakness in low-end wines was well-known, Sands argued, noting that "that segment of the wine industry is performing very poorly" on the whole and that Constellation is working on fixing that issue in the near term.

"It's something that we identified, actually, several months ago, and we said that we were pursuing strategic alternatives for that segment of our business," he said. "In fact, we are, and expect to come to some conclusions relative to that in the near future."

Another strategic imperative for the company is cannabis, as evidenced by its $4 billion stake in Canadian marijuana producer Canopy Growth. Constellation, which also presides over popular beer brands Corona and Modelo, now has warrants to make its nearly 40 percent stake in Canopy even larger.

Even with that and the wine consumption downtick, the company plans to return $4.5 billion to shareholders in the next three years via dividends and buybacks, incoming CEO Newlands said.

"This remains a strong cash-generation business" despite some analysts' criticisms about Constellation's balance sheet risk, he told Cramer. "We're in a great position, we continue to be in a great position, and the strength of our beer business is going to continue to have us in a great position going forward."

Sands added that assuming Constellation follows through on its shareholder returns and exercises all of its warrants in Canopy, his company will still get back to its goal debt-to-EBITDA range of 3.5 to 4.0. Debt-to-EBITDA measures a company's capacity to pay off its debt.

Cramer also sat down with Canopy Growth founder, Chairman and CEO Bruce Linton on Wednesday. To watch that interview, click here.

Clarification: This story has been updated to reflect that Sands and his brother purchased Constellation stock via an option that allowed them to purchase it at $11.85 a share.

Watch Rob Sands and Bill Newlands' full interview here:

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com