The benchmark that the Federal Reserve uses to set interest rates could become more volatile as the central bank continues to unwind the portfolio of bonds on its balance sheet.

Fed officials conducted further discussions about the impact of balance sheet reduction at their December meeting, with members noting the work it will take to make the operation proceed smoothly, according to minutes released Wednesday.

The Fed ran its balance sheet, comprised mostly of Treasurys and mortgage-backed securities, up to $4.5 trillion in operations during and after the financial crisis in an effort to lower interest rates and stimulate the economy.

At present, the central bank is allowing $50 billion a month in proceeds it gets from the bonds to run off the balance sheet, and is reinvesting the rest.

While officials have said they see the operation progressing smoothly, the mechanics are getting complicated.

The meeting summary reflected sentiment that as the balance sheet declines and bank reserves fall, the federal funds rate, which banks charge each other for overnight lending but also serves as a barometer for adjustable-rate consumer debt, may rise above the interest the Fed pays on excess reserves.

'Become somewhat volatile'

The interest rate on excess reserves, also know as the IOER, generally runs higher than the funds rate and has been able to keep the benchmark in check. Twice in 2018 the Fed raised the IOER by 20 basis points while hiking the funds rate by 25 basis points in order to hold back the rise of the latter, which eventually matched the IOER.

Fed staff members "noted that the federal funds rate and other money market rates could possibly become somewhat volatile at times as banks and financial markets adjusted to lower levels of reserve balances," the minutes said.

"Were upward pressures on the federal funds rate to emerge, it could be challenging to distinguish between pressures that were transitory and likely to abate as financial institutions adjust and those that were more persistent and associated with aggregate reserve scarcity," the meeting summary added.

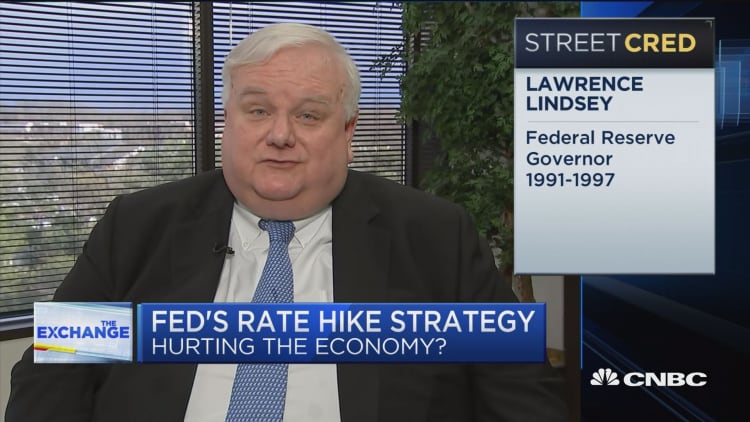

The Fed has been reducing its balance sheet while also raising interest rates. President Donald Trump has criticized Chairman Jerome Powell and his colleagues for tightening, saying that Fed policy represents the biggest threat to the economy.

Fed officials presented several alternatives for handling a possibly volatile funds rate — reducing the IOER further, conducting open market operations or slowing the balance sheet operation, for example. However, "such options were recognized to have limitations in some situations."

"Participants considered it important to present information on the Federal Reserve's balance sheet to the public in ways that communicated these facts," the minutes said.

Officials expect to continue the discussions in the future as the balance sheet is further reduced. Since the roll-off program began in 2016, the balance sheet has declined by about $400 billion.