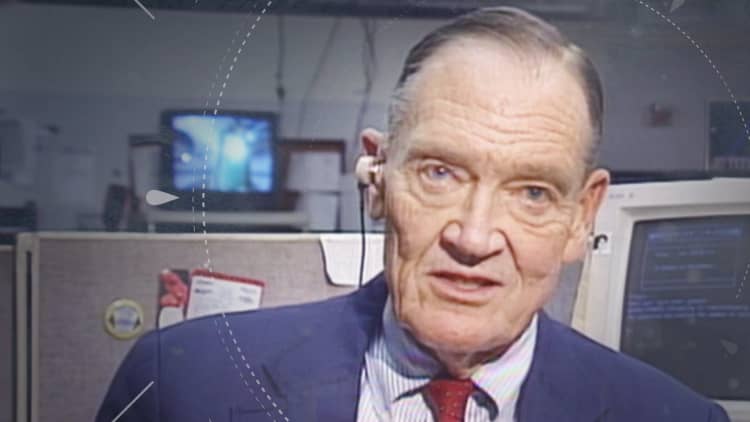

Warren Buffett paid tribute to Jack Bogle at Berkshire Hathaway's annual meeting in 2017, which Bogle attended just days before his 88th birthday.

(See the video above)

Bogle revolutionized investing for regular people, Buffett said. While Nobel-winning economist Paul Samuelson and value-investing pioneer Benjamin Graham had talked about the idea of an index fund, Bogle is the one who actually put the concept together at the fund company he founded in 1975, Vanguard Group. And he did this despite resistance from others on Wall Street, which had a vested interest in maintaining the status quo.

Index fund investing has dramatically lowered the cost of investing for mom and pop investors and made a once-complex activity easy and quick.

"It wouldn't have happened without him," Buffett said.

Bogle died Wednesday at age 89. But his legacy will live on in Vanguard, which has grown to be one of the world's largest fund companies, with $5.1 trillion of assets under management.

"Index funds, overall, have delivered for shareholders a result that has been better than Wall Street professionals as a whole," Buffett said at the 2017 meeting. The index fund has put "tens and tens of billions into their pockets. And those numbers are going to be hundreds and hundreds of billions over time."

Buffett reiterated these words in comments to CNBC following Bogle's death.

Friendship with Buffett

Bogle reminisced about his trip to Omaha in a column for the Omaha World-Herald last year. Steve Galbraith, a long-time Bogle friend and former Morgan Stanley executive, persuaded Bogle to make the trip. Once on the ground in Nebraska, Bogle said he marveled at the reception he got from Berkshire shareholders and from Buffett himself.

"I confess that, on this one grand occasion, I found huge satisfaction in being recognized for my contribution to the world of investing, and to the wealth of the human beings who have entrusted their assets to Vanguard's index funds. (I'm only human!)," Bogle wrote in the column.

"Accolades are nice, and endorsements are, too, but human connections are what life is largely about. I celebrate the friendship and mutual admiration that I've shared with Warren Buffett and Steve Galbraith, men of integrity, wisdom and class."

Here are Buffett's complete comments that day in 2017:

Jack Bogle has probably done more for the American investor than any man in the country. (Applause)

And Jack, would you stand up? There he is. (Applause)

Jack Bogle, many years ago, he wasn't the only one that was talking about an index fund, but he — it wouldn't have happened without him.

I mean, Paul Samuelson talked about it. Ben Graham even talked about it.

But the truth is, it was not in the interest of invest — of the investment industry of Wall Street. It was not in their interest, actually, to have the development of an index fund — the index fund — because it brought down fees dramatically.

And, as we've talked about some in the reports, and other people have commented, index funds, overall, have delivered for shareholders a result that has been better than Wall Street professionals as a whole.

And part of the reason for that is that they've brought down the costs very significantly.

So when Jack started, very few people — certainly Wall Street did not applaud him, and he was the subject of some derision and a lot of attacks.

And now we're talking trillions when we get into index funds, and we're talking a few basis points when we talk about investment fees, in the case of index funds, but still hundreds of basis points when we talk about fees elsewhere.

And I estimate that Jack, at a minimum, has saved — left in the pockets of investors, without hurting them overall in terms of performance at all — gross performance — he's put tens and tens and tens of billions into their pockets. And those numbers are going to be hundreds and hundreds of billions over time.

So, it's Jack's 88th birthday on Monday, so I just say happy birthday, Jack, and thank you on behalf of American investors. (Applause)

And Jack, I've got great news for you.

You're going to be 88 on Monday, and in only two years you'll be eligible for an executive position at Berkshire. (Laughter)

Hang in there, buddy. (Laughter)

(Watch other Buffett moments through CNBC's Warren Buffett Archive.)

— With reporting by CNBC's Alex Crippen

WATCH: