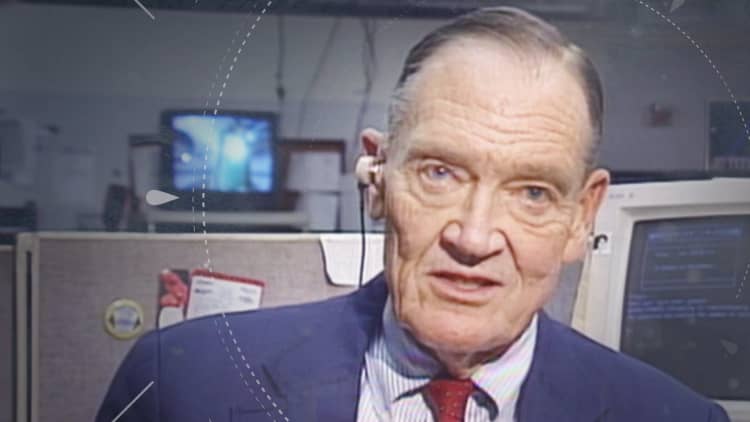

Former Vanguard Group Chairman and CEO F. William McNabb told CNBC that his first meeting with Jack Bogle, and the one that made a lasting impression on him, was his interview for a product manager position at the fund company in 1986.

Bogle, the founder of Vanguard who is credited with revolutionizing the investment business, had his feet propped up during the interview because of "doctor's orders" while he recovered from a heart attack. "It's the only concession I'll make to be in the office," McNabb recalled Bogle saying.

At the time, McNabb was working on Wall Street after graduating from the University of Pennsylvania's Wharton School, but Bogle didn't ask McNabb one question about his resume. Instead, they talked about values, education and books.

It was emblematic of the type of company Bogle had built and of his legacy, McNabb told CNBC. Bogle died Wednesday at age 89.

Bogle believed that culture trumped strategy every time and that Vanguard would be a place where everyone's contribution was valued and respected, McNabb told CNBC on Friday. The culture Bogle fostered at Vanguard was one of hard work, treating everyone with respect, always doing the right thing and putting clients' interests first, McNabb said.

Bogle feared complacency. He was inspired by the writings of American revolutionary Thomas Paine, who was often quoted in Bogle's books, and the economist Joseph Schumpeter, who popularized the term "creative destruction." What other industry executives found disruptive, Bogle thought necessary to remain relevant.

"When you look at Vanguard today, we are a result of a lot of those steps," said McNabb.

In its first year, Vanguard managed $1.7 billion of customer assets, and when Bogle stepped down as CEO, Vanguard had reached $250 billion assets under management. The company now manages $5.1 trillion, largely because of the popularity of Bogle's industry-changing idea: index mutual funds.

McNabb became CEO of Vanguard two weeks before the fall of Lehman Brothers in 2008. Amidst the turmoil of the financial crisis, he asked himself, "what would Jack do?," and recalls Bogle's favorite phrase: Press on, regardless.