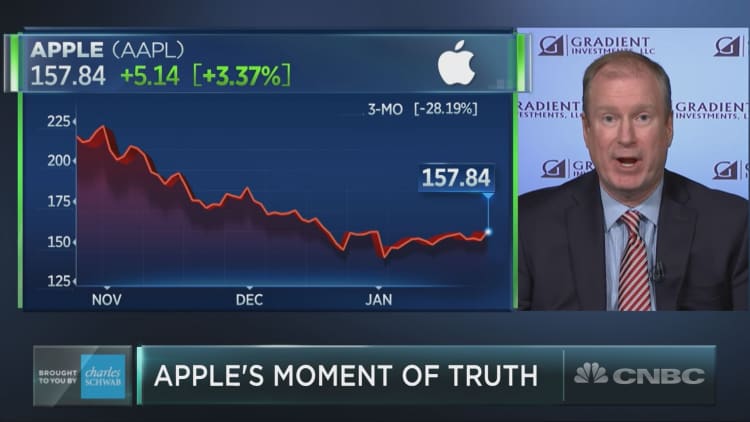

It's Apple's moment of truth this week.

The iPhone maker is scheduled to release quarterly earnings after the bell Tuesday in a report that could make or break any market rally.

Even if Apple sees a post-earnings pop, one market watcher recommends selling any rally.

"We own the stock right now, but we are relatively underweight," said Michael Binger, president of Gradient Investments. "I truly think that the posture right now is to be underweight or not own Apple. They've already announced this quarter, so we know what it's going to be."

"If the stock does happen to rally, we would be more of a seller than a buyer," he added on Friday on CNBC's "Trading Nation."

Apple cut its revenue guidance at the beginning of the year to $84 billion for its fiscal first quarter, down from a previous range of $89 billion to $93 billion. CEO Tim Cook said the reduced forecasts were tied to challenges in China.

The major question for Apple to answer come earnings on Tuesday is whether it has bulked up its ancillary businesses to make up for weakness in its hardware sales, says Boris Schlossberg, managing director of FX strategy at BK Asset Management.

"The story with Apple is, can you teach an old dog new tricks? Can you take essentially a hardware company and turn it into a software services behemoth?" Schlossberg said on "Trading Nation" on Friday.

Weaker iPhone sales in recent months have shaken investors. Apple announced in early November that it would withhold unit sales each quarter, a decision many took as a warning sign that the company's smartphone sales would not bounce back to previous levels. Growth in its services segment has held up well, climbing by more than 20 percent in fiscal 2017 and 2018.

"I'd be a seller of puts here," added Schlossberg. "It's tremendous value and a long-term hold, but you've got to pick your spots here where you want to buy. I'd rather sell the $140 puts and buy it at those levels rather than buy it here and chase it up."

Selling a put is a bullish bet that the stock will rise above the strike price of the option being sold.

Schlossberg says he's using that strategy as a way to hedge against any downside surprises out of the earnings report.

Disclosure: Gradient Investments holds Apple shares.