Despite your best budgeting efforts, your winter getaway to the Caribbean could still land you in the red.

Those were the findings from a recent data analysis by Mint, a budgeting app.

Last year, 2.2 million of the app's users created a monthly travel budget, setting aside cash to save for a vacation goal.

Best intentions notwithstanding, 44 percent of those cost-conscious travelers still managed to blow their budgets and spend more than they had stashed away.

"Travelers may undershoot their vacation budgets for a variety of reasons," said Keri Danielski, head of communications for Intuit Turbo & Mint.

"More than likely, vacationers exceed their budgets by not keeping a close eye on their spending during their trip," she said.

Here are some of the costs that can inflate your vacation tab.

Surprise fees

"Oftentimes, people may overlook the small expenses that are part of traveling," said Danielski.

"Airport meals, rideshare fares, tipping the bellhop — all these less-considered costs can eat up your budget when you're not accounting for them during the planning and budgeting stages," she said.

Perhaps the sneakiest fees are the ones added to your hotel bill. For instance, if you're staying at a hotel, keep an eye out for a "resort fee."

This extra cost is supposed to cover gym access, pool use and Wi-Fi, and it can run average of about $27 a day, according to ConsumerReports.com.

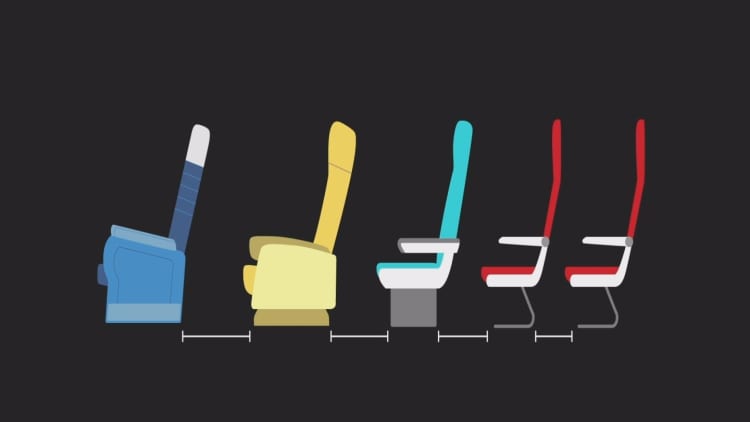

Here's another unexpected cost: airline fees. Those expenses include baggage checking fees, additional costs for early check-in and use of the overhead bins.

Loading up debt

Naturally, blowing out your budget is terrible news for your bottom line.

As many as 8 out of 10 parents said they would go on a summer vacation and they expected to charge an average of $1,019 on their credit card, according to NerdWallet's March 2018 online poll of 1,194 U.S. parents.

Interest would add $452 to that credit card bill, the personal finance site found.

Stay informed

Reduce the number of surprise expenses by plotting out the finest details of your vacation.

Do your research: Consider traveling during off-peak seasons and days in order to shave a few bucks off your trip.

For instance, right now might be a good time to book that trip to Catalina Island in California, according to TripAdvisor Rentals.

That's because the median weekly vacation rental rate is lowest in January and February: $1,864. In comparison, the median weekly rate is highest during the second week of July: $3,457.

Plan out your must-sees: Draft a schedule of your tourist stops.

"This way you already know what you're planning to allocate funds to, meaning you're less likely to agree to spontaneous last-minute plans that could throw off your budget," said Danielski.

List all of your expenses: Your hotel stay and flight are just two components of your trip. Build in reasonable allowances for food and transportation, too.

"This may mean staying at an Airbnb, where you're able to cook meals at home and looking at relative prices for ride-sharing apps versus renting a car," said Danielski.

More from Personal Finance

10 great college towns for retirees

Live at the beach for $3,000 a month in these five cities

This retirement plan feature can help you save on taxes