Investors should prepare to do some buying in the week ahead as still-strong job growth and a patient Federal Reserve continue to improve the outlook for stocks, CNBC's Jim Cramer said Friday after a day of modest gains for the averages.

"We're still basking in the glow of a Fed gone pragmatic, while employment stays strong and inflation is tame. That's the ideal backdrop for stocks," he said on "Mad Money." "I say be ready to buy the next dip, because 2019, which was supposed to ... be the year the business cycle finally keels over, may turn out to be surprisingly rewarding."

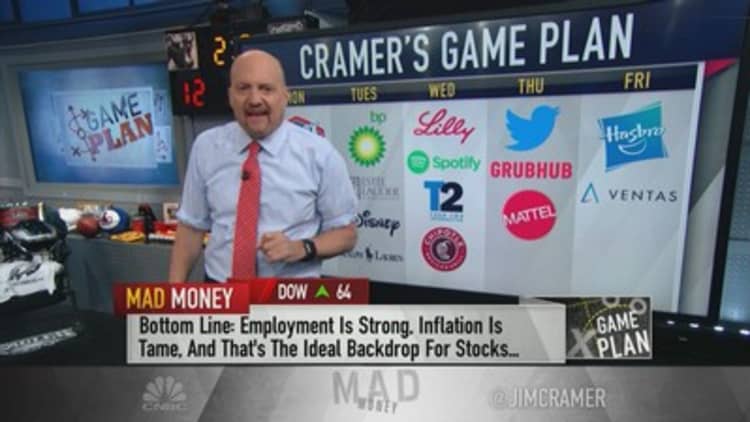

With that in mind, Cramer got right to his busy game plan for the week ahead:

Monday: Clorox, Alphabet

Clorox: Cramer expects Clorox's earnings report on Monday to be "excellent."

"We may actually see the beginning of its raw costs coming down," he said, adding that it "could allow the stock to re-assert its leadership in the consumer products group."

Alphabet: Google parent Alphabet also reports, but Cramer wasn't so rosy on it after what he saw in the stock of Amazon after its Thursday conference call. He maintained a tentative buy call on Amazon, telling investors to wait until Tuesday before buying, but said Alphabet still has something to prove.

"It needs to show us some leg. It has to tell us about Waymo orders. [...] It's got to give us a clear path for bigger YouTube profits. It says nothing about it. It needs to give us some hints about whether it might want to bid on something big for entertainment," he said. "Unfortunately, I doubt [Alphabet] will do any of that, and while we still own this one for my charitable trust, ... we're getting mighty impatient after the shellacking we took in Amazon."

Tuesday: BP, Estee Lauder, Ralph Lauren, Disney

BP: Cramer expects BP's earnings results to "be every bit as good" as those of its counterparts, Chevron and Exxon-Mobil.

Estee Lauder: The "Mad Money" host would normally be worried about this beauty giant's China exposure, but after seeing strong results from Yum China and the gambling players in Macau, he felt OK about its Tuesday report.

Ralph Lauren: Ralph Lauren may have struggled at the end of its latest quarter, but Cramer thinks its management team might be righting the ship.

"We've been itching to buy Ralph Lauren for the charitable trust, but haven't yet pulled the trigger," he said. "It is mighty tempting."

The Walt Disney Company: Disney CEO Bob Iger will have a lot of positive things to talk about in this earnings report, Cramer said, including the success of ESPN+ and the acquisition of Twenty-First Century Fox's entertainment assets.

"I'm hoping it comes down so we can buy more into weakness," he said of Disney's stock, which his charitable trust owns.

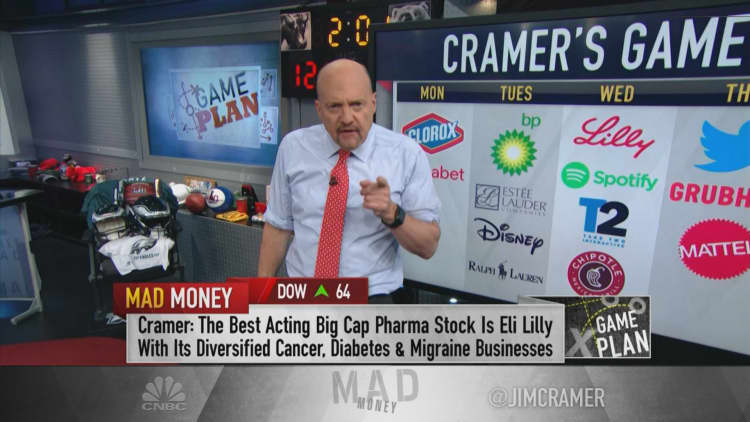

Wednesday: Eli Lilly, Spotify, Take-Two Interactive, Chipotle

Eli Lilly: If you ask Cramer, Eli Lilly remains "the best-acting big pharma stock" in the market ahead of its Wednesday report. He lauded the company's cancer, diabetes, migraine and arthritis drug franchises, but also issued a warning.

"Be careful: it's a stretch to think that Lilly can still keep running," he said. "Maybe if you get a marketwide pullback, though, perhaps caused by something that has nothing to do with Eli Lilly — think China — that might be a chance to buy some ahead of this quarter."

Spotify and Take-Two Interactive Software: Neither music streamer Spotify nor video game maker Take-Two Interactive has gotten enough respect, Cramer said ahead of their earnings reports.

"There's a lot of skepticism surrounding both of these companies, even as I regard them as staples in millions of homes," he said. "Let's see what's happening here."

Chipotle Mexican Grill: Wall Street estimates for this fast-casual restaurant chain have inched higher and higher in recent weeks, so Cramer told investors to prepare for a "blowout" when Chipotle issues its quarterly results.

"CEO Brian Niccol, late of Taco Bell, has orchestrated a magnificent turnaround here. I like the story — I just remember that the stock's already up pretty substantially," he said.

Thursday: Twitter, GrubHub, Mattel

Twitter: Investors might not find out exactly how much President Donald Trump's tweets have helped Twitter's earnings on Thursday, but they will see the company's quarterly results. Cramer expects a solid report given Twitter's ad power.

GrubHub: Positioned squarely at the center of "one of the hottest and most contested spaces out there," delivery giant GrubHub also releases its quarterly earnings, Cramer said.

"Employment is so tight in this country, I don't know if GrubHub can get all the workers it needs, especially with Uber Eats breathing down its neck," he said. "It might be the labor cost issue that fells the stock of this very well-run company."

Mattel: Cramer thinks Toys R Us' liquidation of its U.S.-based stores may still be wreaking havoc at Mattel, adding that the toymaker's "balance sheet needs a fixup."

Friday: Hasbro, Ventas

Hasbro: Mattel competitor Hasbro may also be feeling the lingering effects of Toys R Us' closures, but Cramer liked this company more ahead of its report.

Ventas: This real estate investment trust has long been one of Cramer's favorites, especially considering its 5 percent yield and leading position in the senior housing space.

"I bet it delivers a fine quarter on Friday. I bless buying some ahead of the results," the "Mad Money" host said.

WATCH: Cramer's game plan for Alphabet, Twitter and more

Disclosure: Cramer's charitable trust owns shares of Alphabet, Amazon, BP and Disney.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com