Oil prices were more than 1 percent on Tuesday on steep OPEC production cuts and Saudi Arabia's plan to drop March crude output by more than a half a million barrels per day below its pledge.

Rising investor optimism for a breakthrough in the latest round of U.S.-China trade discussions also boosted futures.

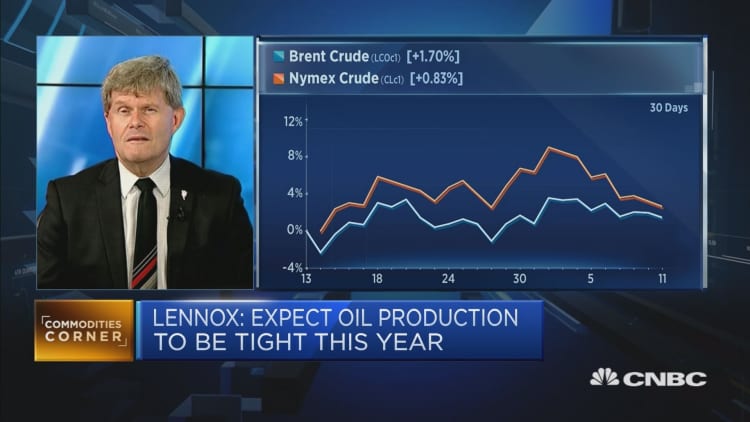

International benchmark Brent crude futures were up 81 cents, or 1.3 percent, at $62.32 a barrel around 2:30 p.m. ET. U.S. West Texas Intermediate crude oil futures ended Tuesday's session up 69 cents, or 1.3 percent, at $53.10 a barrel.

Production cuts implemented Jan. 1 by OPEC and allies led by Russia have tightened markets in the face of rising output in non-member countries, including the United States.

OPEC said on Tuesday it had reduced oil production almost 800,000 bpd in January to 30.81 million bpd under its voluntary global supply pact.

Saudi Energy Minister Khalid al-Falih told the Financial Times that the kingdom would reduce production to about 9.8 million bpd in March to bolster oil prices.

Investors were also hopeful that a new round of talks between U.S. and Chinese officials would bring the two sides close to resolving their ongoing trade war ahead of a March 1 deadline.

"The potential for, maybe, an agreement between the U.S. and China has pushed prices higher," said Tom Saal, senior vice president at INTL FCStone in Miami.

U.S. Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer arrived in Beijing on Tuesday before high-level talks set for later in the week.

The fact that top ranking officials were entering the negotiations "elevated the expectations a little higher" for a deal, Saal said.

If the two sides do not come to an agreement by the deadline, U.S. tariffs on $200 billion worth of Chinese imports are scheduled to increase to 25 percent from 10 percent.

Rising U.S. oil production, fighting near Libya's main oilfield, sanctions on Venezuela and suspense over whether Washington will grant more waivers to import Iranian oil have left markets unsure about broader supply.

U.S. crude stockpiles were forecast to have risen last week for a fourth straight week, ahead of data from the American Petroleum Institute, an industry group, at 4:30 p.m. EST (2130 GMT). The Energy Information Administration will issue its report on Wednesday.

Also on Tuesday, OPEC cut its forecast for 2019 world oil demand, citing slowing economies and expectations of faster supply growth from rivals, underlining the challenge it faces in preventing an oil glut.

Bank of America warned of a "significant slowing" in global growth.