A storm has been brewing around the cloud stocks for weeks now, and traders are expressing some uncertainty as the final name in the space gears up to report earnings.

Following results from Dropbox, Workday, Box and Salesforce that spooked the street, all eyes are on Oracle ahead of its earnings report on March 14. Unfortunately, despite its nearly 17 percent climb to start 2019, traders aren't convinced sunny skies are ahead for the company, said "Fast Money" and "Options Action" trader Dan Nathan.

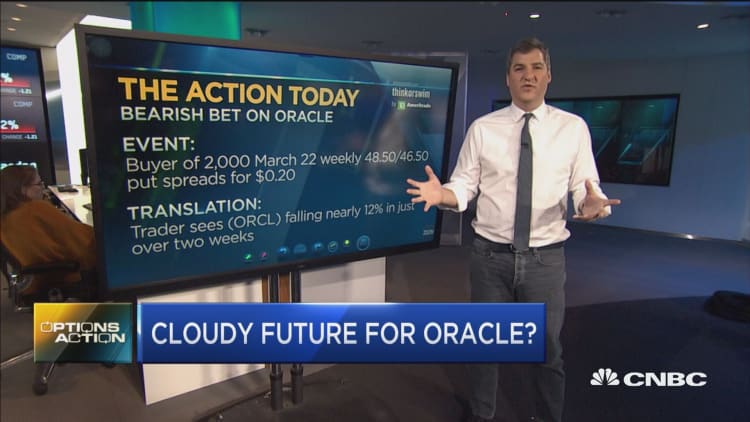

"Looking out to March 22 weekly expiration, there was a buyer of 2,000 of the $48.50/$46.50 put spreads, only paying 20 cents for those," Nathan said Tuesday on "Fast Money." This is a bearish bet that Oracle shares will fall as low as $46.50, or 11 percent from current levels.

"That is a long shot, but I think it's really important to remember that this trader is risking 20 cents to possibly make $1.80 [per contract]."

Nathan also noted that this trader could possibly be using this strategy as insurance against a negative earnings result. If the trader is long Oracle, hedging their position with a put spread could potentially be a low-cost way to collect some money and cushion the short-term blow if their long position in the stock loses value.

On the flip side, Nathan pointed out that — despite light guidance from other names in the space — Oracle's trading history is about as steady as they come.

"This stock trades really, really well," said Nathan, "[after] that massive double bottom, the stock has massively outperformed, but it's actually — just like Salesforce before it — caught some resistance, at least from a technical standpoint."

Nathan said the stock's long-term performance trend could actually be a sign that it's set for a spike to the upside.

"This is a really beautiful uptrend here," he said. "It hasn't had this massive outperformance like names like Salesforce, but trading at about 15 times [forward earnings], you're seeing this consolidation here, and it kind of looks ready to go. … It could be set for a breakout."

Oracle was trading slightly lower on Wednesday.