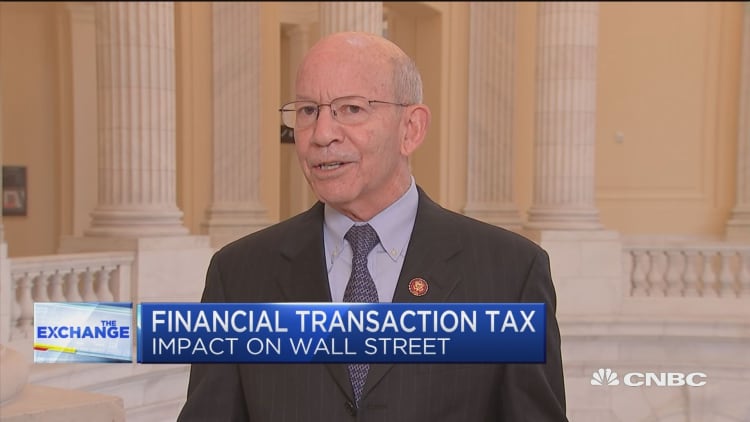

Rep. Peter DeFazio wants to tax financial transactions — but he said in the end that it will be a "net wash" for those who aren't high-frequency traders.

His legislation, the "Wall Street Tax Act of 2019," would slap a 0.1 percent tax on securities transactions. Measures were introduced in both chambers of Congress earlier this week by DeFazio, D-Ore., and Sen. Brian Schatz, D-Hawaii. The idea is co-sponsored by several lawmakers, including Rep. Alexandria Ocasio-Cortez, D-N.Y.

While business groups are already coming out against the plan, DeFazio told CNBC that the bill is aimed primarily at "high-velocity hedge-fund traders."

"They front run the market with supercomputers and algorithms" and get information "nanoseconds" before everyone, drive up the price and then sell, he said Friday on "The Exchange." "The game is fixed. They don't add any value and they jack up prices and they create volatility."

He argues the tax, which the Joint Committee on Taxation said would increase revenues by $777 billion over 10 years, will help put some of those high-frequency traders out of business.

"It would drive those leeches who are front running the market out of business because ... the way they are trading now, they can't afford that tax," he said. "It would be a net wash for value investors, long-term investors [and] pension funds. We would get rid of some of the high-velocity hedge fund folks and we would have calmer markets."

The U.S. Chamber of Commerce, the most prominent business group in the nation, has already spoken out, saying a tax hike like this one would decrease returns for Americans. The political network backed by billionaire Charles Koch —Americans for Prosperity — and high-frequency trading advocate Modern Markets Initiatives have also gone on the offensive.

DeFazio's proposal is just the latest by Democrats to target the wealthy. Sen. Elizabeth Warren, the presidential hopeful from Massachusetts, wants a wealth tax of 2 percent on households with more than $50 million in assets and 3 percent on households with $1 billion or more. Ocasio-Cortez has proposed a 70 percent marginal tax rate on income of more than $10 million.

— CNBC'S Brian Schwartz contributed to this report.