Lyft increased its expected IPO share price range to between $70 and $72 per share in a new filing Wednesday. The company previously expected to price its shares between $62 and $68.

The company would be valued around $20 billion in the updated pricing range.

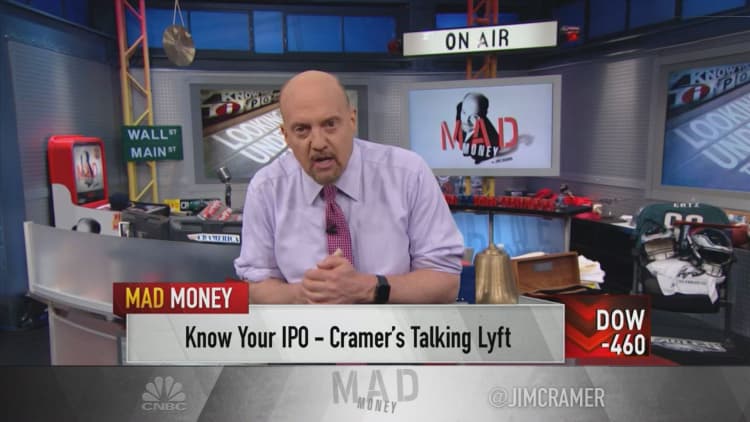

Lyft is expected to price its shares Thursday and go public Friday on the Nasdaq under the ticker LYFT.

The company has been clawing market share from industry leader Uber, according to its S-1 filing that was released earlier this month. Lyft claimed 39 percent of the U.S. market at the end 2018, up 17 percentage points over two years, according to the filing.

Here's how the company said it did in 2018:

- Net loss: $911 million, an increase of 32 percent from 2017

- Revenue: $2.2 billion, double the revenue it saw in 2017

- Bookings: $8.1 billion, an increase of 76 percent from 2017

Lyft is one of several large tech companies expected to go public this year, including Uber, Pinterest, Zoom and Slack. Uber, Lyft's chief rival, is expected to release its S-1 and go public in April.

Lyft has been named to the CNBC Disruptor 50 List three times, ranking fifth on the 2018 list.

J.P. Morgan, Credit Suisse and Jefferies are the lead underwriters of the offering.