The biggest one-week rate drop in a decade unleashed a run on refinances last week, although it did not especially spur spring buyers.

Mortgage application volume surged 18.6 percent from the previous week and 28 percent from a year ago, according to the Mortgage Bankers Association's seasonally adjusted index.

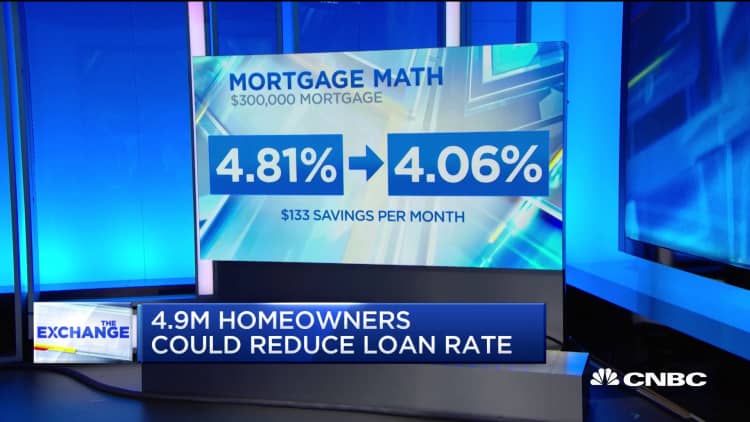

Refinance applications jumped 39 percent for the week to the highest level since January 2016. Volume was 58 percent higher than a year ago, when interest rates were higher.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.36 percent from 4.45 percent, with points increasing to 0.44 from 0.39 (including the origination fee) for loans with a 20 percent down payment. The rate was 33 basis points higher than a year ago.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350) decreased to 4.21 percent from 4.35 percent.

"There was a tremendous surge in overall applications activity, as mortgage rates fell for the fourth week in a row – with rates for some loan types reaching their lowest levels since January 2018," said Joel Kan, MBA's associate vice president of economic and industry forecasting. "Refinance borrowers with larger loan balances continue to benefit, as we saw another sizable increase in the average refinance loan size to $438,900 — a new survey record."

Mortgage borrowers looking to purchase a home did not respond quite as aggressively. Those applications increased 3 percent for the week and were 10 percent higher than a year ago. Lower rates may be helping more buyers get into their first home.

"The average loan size for purchase loans declined slightly, as applications for smaller purchase loan sizes exceeded that of higher loan sizes — a positive sign that first-time buyers were increasingly active in the market," Kan said.

The run on refinances may already be dying down, however. Mortgage rates bounced back sharply this week, ending Monday about an eighth of a percentage point higher than they were a week ago, according to Mortgage News Daily. They stabilized Tuesday.

"Ultimately, the next move is most likely to be determined by the economic reports that come out between now and Friday morning," wrote Matthew Graham, chief operating officer of MND. "This keeps volatility potential elevated between now and then, with the biggest swings reserved for mid-morning on Friday following the big jobs report."