Japanese conglomerate SoftBank Group Corp announced a stock split while keeping the per-share dividend unchanged for the year, effectively doubling its shareholder payout, as it also reported a better-than-expected annual profit.

The news comes at a time when SoftBank and its almost $100 billion Vision Fund stand at a possible inflection point with some of its big tech bets like Uber Technologies heading to trading markets, in what investors and industry experts see as a test of SoftBank's strategy.

The group is also considering listing the Saudi-backed Vision Fund, which has invested roughly $80 billion in around 80 tech firms, a source told Reuters last week.

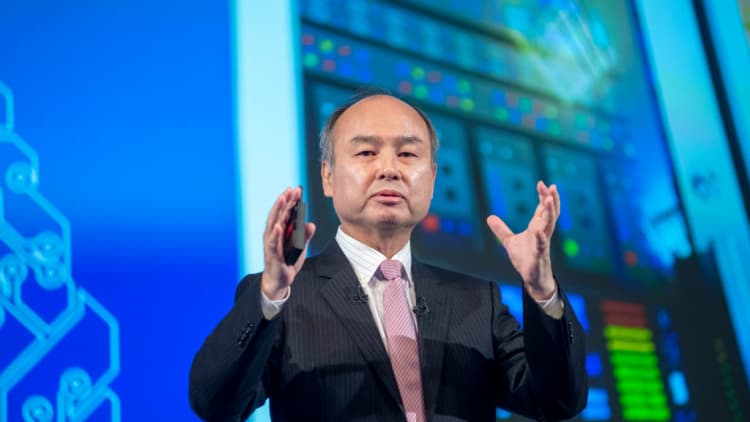

A second Vision Fund will be announced soon, SoftBank Group founder and CEO Masayoshi Son said at a news conference on Thursday, adding it would be similar in size to the first fund with SoftBank likely to be the only investor initially.

The value of Vision Fund's investments in 69 companies had risen to $72.3 billion by end-March, from their $60.1 billion acquisition cost, driven by gains at companies like Uber and Indian hotels startup OYO, SoftBank said on Thursday.

The fund's stake in Uber, which debuts on Friday, grew 418 billion yen in value, while its share in OYO added 154 billion yen in value. Overall, the fair value rose for 29 firms and fell for 12 over the period, SoftBank said, with the rest unchanged.

The value of its stake in Guardant Health, a Vision Fund portfolio company listed last year, grew 203 billion yen.

Aided by the soaring valuations of its tech investments, SoftBank Group's operating profit for the year ended March jumped 80.5 percent to 2.4 trillion yen ($22 billion).

That was above a 2.1 trillion yen SmartEstimate that gives a greater weighting to top-rated analysts, Refinitiv data shows.

The tech and telecoms group said its common stock will be split at a two-for-one ratio on June 27, while its dividend will remain unchanged at 44 yen per share.

SoftBank's transition away from telecoms toward tech investments accelerated with the 2.35 trillion yen listing of a third of its domestic telco SoftBank Corp in December in what is Japan's largest-ever initial public offering.

That provided the funds for a share buyback that has helped drive up SoftBank Group's stock by nearly 60 percent this year. The shares closed up 0.7 percent ahead of the earnings.

On Wednesday, the group said it would sell down its share in Yahoo Japan as SoftBank Corp hiked its stake in the internet firm to 45 percent in a deal that will function as a transfer of funds from the telco to its parent.

The market welcomed the news, with SoftBank Corp's shares up 7 percent on Thursday and Yahoo Japan's shares up 9.4 percent.

SoftBank Group did not provide a forecast for the current financial year, citing uncertain business factors.