Nvidia CEO Jensen Huang doesn't expect Chinese regulators to stand in the way of its nearly $7 billion takeover of Israeli chip designer Mellanox Technologies.

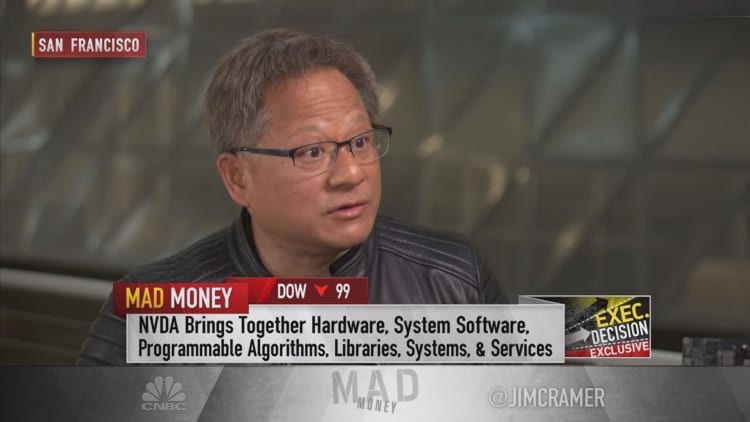

In an interview that aired Friday on "Mad Money," Huang told CNBC's Jim Cramer that the merger will fulfill an important function for data center security networking and storage processing. China, which is engulfed in a tense trade war with the United States, is a major semiconductor market where both companies sell a large portion of their products.

Cramer said he worried that the country's regulators could vote to block the merger, as one of several international councils to evaluate global deals.

"I think China is going to love it," Huang said in the sit down with Cramer. "[Mellanox is] the world's best at connecting high performance systems, and we've been working with them for a long time."

Huang isn't worried that the tariffs lodged between the world's largest economies will directly impact the semiconductor manufacturer's business. Nvidia, which also has its thumb on the pulse of gaming and artificial intelligence, is confident about its supply chain.

"The vast majority of our technology and products are created in Taiwan, so we're not affected largely by the tariffs," he said.

Nvidia on Thursday reported an earnings and revenue beat for its fiscal first quarter of 2020. However, it saw its second straight quarter of revenue decline. Revenue fell 24% year over year during the company's fiscal fourth quarter and 31% year over year during the company's fiscal first quarter.

Data center spending during Q1 came in at $634 million, nearly 5% lower than the $663.7 million FactSet consensus estimate.

The chipmaker is forecasting $2.55 billion in revenue for the current quarter, which would represent another year-over-year decline of roughly 18%.

Huang pointed to what he called a "hyper-scale spending pause" and said the period of reduced sales lasted longer than expected. Nvidia supplies chips for cloud services like Amazon's and Alphabet subsidiary Google's, among other firms. The "hyper-scale" clients are firms that run online consumer services and cloud infrastructure.

"All of the data centers, the hyper-scalers, bought a little too much last year," he said. "They bought too much in Q4. And so they're gonna take a quarter or two to digest it."

Nvidia is continuing to focus on its major growth drivers, including ray tracing computer graphics and artificial intelligence, Huang said.

"I think that it is now forgone conclusion that ray tracing is going to define the next generation of computer graphics and so I'm very pleased with that," Huang said. "The amount of computation that's gonna be done in the cloud because of artificial intelligence is growing and is growing incredibly fast, arguably exponentially."

Shares of Nvidia fell 2.3% Friday. The stock is up more than 17% in 2019, but is down nearly 37% in the past 12 months.

WATCH: Cramer sits down with Nvidia CEO Jensen Huang

Disclosure: Cramer's charitable trust owns shares of Nvidia, Amazon, and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com